By Mike Darwin

Figure 1: London, 2012, still magnificent, but declining from apogee.

Timing is (almost) Everything

Most of the essay below was written on 16 June, 2008. It was written as a post (including all of the financial graphics) for a critical care medicine list-serve called CCM-L – a venerable, but at the same time quirky and eclectic forum, for discussing critical care medicine and topics that could transform it, for good or ill (even if they are seemingly far afield from the brass tacks of medical technology, per se). Sometime ago, I’m not sure quite when, I was alerted to the work of the economic analyst (and economist) Michael Mandel’s in the form of his seminal article, “Why the Jobs Crisis is Actually an Innovation Crisis”, by something I saw in an e-communication from the Cato Institute. Mandel’s analysis started me working to rewrite my CCM-L piece into a more rigorous (and less personal) exposition of my ideas. Subsequently, Mandel’s article prompted a more exhaustive and insightful analysis of the current financial meltdown by the even more prestigious economist Tyler Cowen.

Figure 2: Andrew J. Galambos (at right).

Figure 2: Andrew J. Galambos (at right).

I downloaded Cowen’s e-book The Great Stagnation, within days of its e-publication. I agreed with both men’s ideas, and especially liked Cowen’s emphasis on how badly scientists are treated in our civilization and the truly catastrophic effect this has had on innovation and technological progress. In fact, two people in the cryonics community who have known me for some years, Steve Bridge and Danila Medvedev, will, I think, attest that I’ve been going about this idea at length, and bordering on hysteria, for years. In the case of Steve Bridge, it has been for at least 30 years! So, I was very receptive to Cowen’s arguments, because they fit precisely with what Andrew. J. Galambos taught me in 1973-4. (In exchange for the many wasted hours I spent listening to him, the idea of the primacy of intellectual property in creating wealth, and of the high cost of mistreating its creators, made it all worth while).

However, as I read Cowen’s arguments, I realized that he was was fundamentally wrong about a critical issue – namely his assertion that productivity has not increased dramatically sincethe early 1970s as a result of technological advance – in particular stunning advances in computer and informational handling technologies, as well as the associated increased automation in manufacturing. I believe that he and Mandel suffer from not moving about in the world enough and looking at, and really seeing and understanding industrial and manufacturing advances first hand and in the context of 2oth century technological history.

Consider what l am doing now. I am ‘publishing’ the equivalent of a book every couple of weeks! And not just any book, but a lavishly illustrated and very nicely formatted technical book with enormous amounts of research and references. In 1982, it would have taken several times the amount of effort, and a week or two in time, to generate one technical paper 10 pages long, with almost no art, and very few references. Researching papers was nightmarish, and involved driving into Los Angeles, an hour away, and searching the card catalogs at the UCLA Medical Library… Preparing a single article for publication took at least half a dozen people, if you include the printers’ staff.

This would all be of less relevance if the same increase in productivity was not also clearly going on across the board, in the whole of the economy. And it is, and Mandel and Cowen would have realized that this is so, if they ever were closely interfacing with a robust cross-section of industries over a decade’s long period of time.

Because of cryonics, I had to see, interface with, and become familiar with the manufacturing processes of businesses of many kinds. I toured Dow Chemical’s Zionsville research and production facilities, and spent countless hours learning to do tissue culture there when I was 12-13 years old, in 1966-7. So, Mandel and Cowen are clearly wrong about the increase in productivity being slowed to the extent they assert. They are, however, absolutely right that the average man on the receiving end of this technological bonanza has been seeing increasingly flat gains in personal wealth, and now is seeing net losses. That is real. But what they are failing to see, and the question they are failing to ask is, “why did this happen and where did all the wealth from that increased productivity go?” Somebody undoubtedly got richer!

The answer is in my 2008 CCM-L post: this wealth was stolen by hidden taxation and largely hidden (and unappreciated) inflation coupled with irrational and unsustainable expenditures in areas such as health care and Defense. My rough guess is that conservatively, 60 to 70% (more now) of each individual’s productivity is taken from him before he ever gets his paycheck. The decaying, and now failing infrastructure in the US is proof positive that this wealth isn’t going to fund basic and ‘good’ things government can do – such build and maintain roads, dams, utilities, land reserves – and maintain basic public health. INSTEAD, IT IS BEING STOLEN AND WASTED.

So, whilst not disagreeing with either Cowen or Mandel, my point is that they miss the elephant in the room, and if their suggestions for ‘fixing’ things were implemented tomorrow, it would merely result in ever increased thievery, and certainly in no net long term gain for the real producers of wealth.

I have reproduced here my by 2008 post, with minor edits for grammar and punctuation, as it first appeared, minus some irrelevant personal dialogue at the beginning. To this material I have added my analysis of Cowen’s and Mandel’s works, and I have highlighted this added text in gray type. I believe that these two men have indeed identified a critically important idea underlying the current economic crisis and slowdown in innovation. But I do not believe that it is, as Cowen asserts, primarily due to “exploitation of the low hanging technological and natural resource fruit on the tree.” It instead due to theft, and more importantly in the long run, to the debased treatment of the real engines of wealth creation and technological advance: the scientists and all the others in our civilization who innovate and who produce new ideas. Most thinking people now (hopefully) understand that collectivism, when applied to industry or ordinary commerce, quickly destroys incentive and impoverishes the economies of those who practice it. What must now be understood is that collectivism, with respect to intellectual property (the real font of all wealth and progress) is many orders of magnitude more destructive than it is when applied ‘only’ to the means of production. Unfortunately, I believe that this realization will be even more transformative, than it will be long in coming.

- Mike Darwin, 22 January, 2011

As Good as it Gets, for Now?

While I was in London, in June of 2008, I met a banker from Citigroup; a very intelligent and savvy fellow from New York City. Most of you have met, or at least know of the type I’m referring to here; big apartment in Manhattan, house in Connecticut, spouse who is 10 years older and very senior in Merrill, Lynch, Pierce, Fenner, Cooper and Smith. He was in the UK to try to contain massive losses to Citigroup from major clients and, to be blunt, try to save Citigroup itself! I was also told that of Band of America was holding so much suspect paper that it, too, might go-under.

I have long believed a major depression, i.e., collapse of much the apparent worth of the financial system in at least the US, was imminent (imminent in these terms means ~10 years + or – 5). What I was told during this lengthily and intense conversation in late June, made my mouth go dry – and I felt real fear. I have to say that no small part of my happy recreation and carefree time in the UK was motivated by a steadily growing gut feeling that the ‘party was almost over,’ and that this might well be my last chance to really enjoy a world that was at the apogee of 8,000 years of technological civilization. Sounds hyperbolic and melodramatic, but it is nonetheless true – the part about ‘apogee’ and ‘civilization,’ that is…

London, in particular, is at apogee; at no time in the 2,000 year history of the city has it been cleaner, wealthier – more equitably wealthy – healthier, more rational, safer, less prejudiced, more inclusive, more tolerant, better educated, or, arguably, happier. These things are not open for debate: they can be proved by both the objective numbers, and the evidence of the senses. If you visit London, and if you have the slightest inkling of the history of the city, it is obvious that things have never been so good for so many; rich and poor alike (and yes, it is possible for things to be better, even for rich people; dentistry, hip replacement, plastic surgery…) It may credibly be argued that London, and a few other cities like it, represent the absolute apogee in the quality of human life, wealth, technological sophistication and justice, in the entire history of our species.

People on average are more educated, enjoying vastly better health, are living vastly longer, suffering (physically) vastly less and are, in absolute terms, vastly wealthier than at any time in human history. In London, they are seemingly happier, or at least more visibly joyful, than most urban populations I’ve observed. London is one big happy party compared to Moscow, where ‘grim’ and ‘stoic’ are the operational adjectives. People are relaxed; they laugh and talk in public spaces; they smile, incessantly listen to music on tiny devices, and chat on the phone and converse earnestly with each other on the tube, and even on the buses in the wee hours. I am no cheerful Pollyanna, and yet I notice these amazing and rapid positive, and largely technologically driven changes.

A Chance Encounter and an Historical Perspective

Where I differ from most people is that I could put this experience, this chance encounter, with a worried banker, into the context of just about all we know of human history. An arrogant statement, I know, but it is true. I felt both blessed and awed to be in a place, and at a time, where our species has made life the best it has ever been for 15 million people in one place at one time – and to have the opportunity to enjoy it at almost every level. I confess, there was a strong, indeed almost all-pervading sense of “after me, the deluge...”

Figure 3: Gold, the last refuge of the desperate ‘investor.’

Figure 3: Gold, the last refuge of the desperate ‘investor.’

My Citigroup acquaintance, and later a young banker from Credit Suisse, whom I also talked to for several hours, explained the real mechanics of what had been done to the financial system, and how far-reaching and catastrophic they each thought it was going to be. Ironically, while they both had substantial personal means, they were also, as is often the case when you are inside a problem, totally at sea as to what to do personally to protect themselves. I told them that if it was as bad as they said it was, the only thing they could do was to get out debt, convert a fraction of spare cash to gold (preferably K-Rands) and take physical delivery of it; no gold shares, or mining stocks. I said that how much of their assets to convert to gold was a function of how bad they thought and felt it was really going to be – and how much they were willing to risk in terms of large, short-term losses from cashing out time-locked financial instruments, liquidating investments real estate at a suboptimum time, and, of course losing the productive return on their money until the worst of the deflation-inflation was over. Gold neither earns nor creates wealth, but rather is a costly storage mechanism for wealth that halts productive return on capital, is inconvenient to hold and use as currency, and is highly susceptible to theft – without recourse to recompense by insurance.

When I learned in full what the financial community had (most recently) done to precipitate this crisis I was at a loss for words, and so upset that I just sat in the dark and later that day told the good friend I was staying with, in detail, what I had learned. He was a bit sobered by it, but he was, and probably still is, too bewitched by what he sees as the silver lining to this situation (at least from his perspective), to understand how dire it could well become for all of us. He owns properties, and the structure of his investments is such that the falling value of currency and home prices is very advantageous to him, and he believes that his choice of investment properties is essentially secure against even grave economic downturn and contraction. So, I could not reach him with my ‘news’ that sky had indeed started to fall, and clearly I could not reach anyone else with my gloomy message. I thought back to my reading of Thomas and Morgan-Witt’s The Day The Bubble Burst in the early 1980s, about the 1929 Stock Market Collapse, and the ensuing global depression, and about Paul Krugman’s The Return of Depression Economics in 1999 (the book that inspired me to cut loose and start travelling and living (it up)) and, of course, Nassim Taleb’s masterpiece The Black Swan. I realized that this is always the case in such times and in such situations, so I quit playing Chicken Little, and continued to grab life by the balls, (to be both crude and accurate) while I could.

Any fool can say that there will be another 1929, or a similarly bad crisis, and be right on the money, with only one niggling little problem: saying when it will happen with a useful degree of precision. I posted my timeline on CCM-L some time ago, and it ranged from tomorrow, to a year from then, or maybe two years, at most. However, this is neither sufficiently precise, nor does it carry sufficient weight, to have allowed me to be taken seriously. So, I mostly kept my mouth shut, both before and after my trip abroad.

Any fool can say that there will be another 1929, or a similarly bad crisis, and be right on the money, with only one niggling little problem: saying when it will happen with a useful degree of precision. I posted my timeline on CCM-L some time ago, and it ranged from tomorrow, to a year from then, or maybe two years, at most. However, this is neither sufficiently precise, nor does it carry sufficient weight, to have allowed me to be taken seriously. So, I mostly kept my mouth shut, both before and after my trip abroad.

One of the things always said, and widely believed whenever any economic system has gone non-rational, is that “it is a new paradigm” a “new economy,” and that the “underlying economic rules of the game have fundamentally changed.” I find evidence of this going back as far as the Roman Republic! So, when I began really howling about the bad track I saw US finance going down, way back when the Savings and Loan fiasco occurred, and Peter Keating went to jail (briefly), nobody paid attention to me, and they were absolutely right not to have: a whole generation of people came and went in that interval, and vast fortunes were made and lost. But on balance, more were made than lost.

How was this possible? Ironically, the answer turns out to be that the economic lunatics were right, there was a fundamentally new economic paradigm, and it had changed everything, but just not in the way they thought. I’ve actually written on CCM-L about this insight, and this paradigm change. But I’ll recap it here, because it is, shortly (a decade or two from now?) to become received economic wisdom, and part of the canonized explanation for why what is happening now happened, and how it happened.

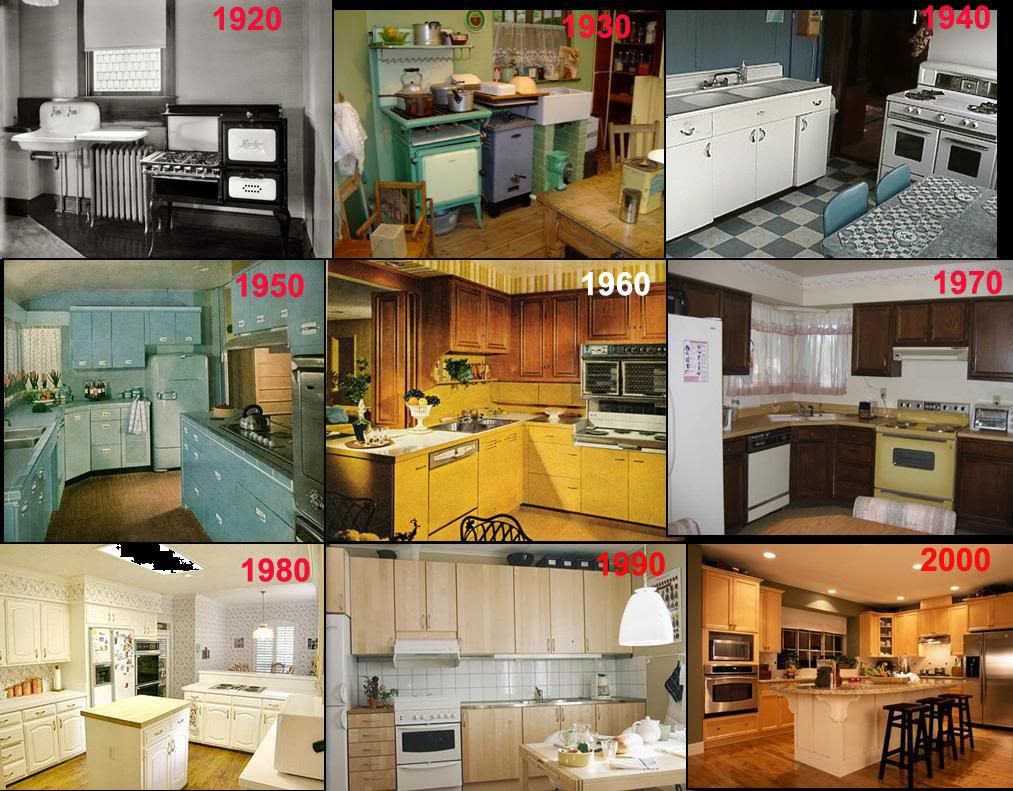

Figure 4: Archetypal ‘modern’ kitchens spanning 80 years of US history.The slowing pace of everyday technological change is most evident in the transition from 1920 to 1940 – a point when so-called ‘low hanging fruit technologies’ such as electrification and civil engineering had matured.

Figure 4: Archetypal ‘modern’ kitchens spanning 80 years of US history.The slowing pace of everyday technological change is most evident in the transition from 1920 to 1940 – a point when so-called ‘low hanging fruit technologies’ such as electrification and civil engineering had matured.

Within the last few months, two prominent economists, Michael Mandel and Tyler Cowen have been writing about what they term is an ‘innovation interruption’ or an ‘innovation slowdown.’ Mandel puts his best case forward in his 2010 article, “Why the Jobs Crisis is Actually an Innovation Crisis”. In his ebook, The Great Stagnation Cowen, argues for this being an era of technological stagnation in considerably greater detail, and invokes a different primary causal mechanism, namely the idea that the US economy has been driven by a binge supper on the “low hanging technological and natural resource fruit” that was available until the early 1970s in the US.

I first noted, and wrote about this slowdown in everyday technological transformation, and working and middle class wealth, in the late 1980s, and I christened it the “Family Affair” paradox. Family Affair was a television sitcom that ran from 1966-71. The program was bland and unremarkable, but one thing I noticed watching a rerun, whilst confined to a doctor’s waiting room, was that nothing in the living spaces that the program played out in would have been out of place in 1989. The only noticeable changes were automobile styling and womens’ couture. Since I am a ‘classic movie buff’ with an insatiable appetite for films from the 1930s through the early 1960s, I noticed that it would be impossible to mistake an interior from 1940, for one from 1950 – let alone 1960. This phenomenon was brought home to me again some years ago when I toured “A kitchens of the 20th Century” exhibit at the Smithsonian, in Washington, D.C. The slowing of apparent technological change and growth in wealth (spaciousness and quality of finishes), mirrored what I had seen in film and television – and what Mandel and Cowen assert their economic analyses also show.

Figure 5: Economists Michael Mandel (left) and Tyler Cowen (right).

Figure 5: Economists Michael Mandel (left) and Tyler Cowen (right).

It wasn’t just fashion or style that had changed; it was the large and very evident increase in the wealth of the working and middle class population, as reflected through those films. The magnitude of change had obviously greatly slowed during the interval from ~1970 to ~1990, but why?

Mandel and Cowen have a number of arguments to explain this slowdown, and far more importantly, they have the solid economic data to back it up. Their arguments are that at least these factors in play:

- The US was still largely virgin territory at the beginning of 20th century. It still had vast fossil fuel reserves, a huge reserve of unexploited and agriculturally rich land, and a largely rural population of intelligent and ambitious young people who were uneducated – and thus could be turned into a valuable asset not previously available. That’s all gone now.

Fig ure: 6: Harvesting the low hanging technological fruit?

ure: 6: Harvesting the low hanging technological fruit?

- The most transformative basic technologies that have created widely distributed wealth and jobs were largely products of the 19th century scientists and entrepreneurs. Edison, Tesla, Ford, Dow, and DuPont did the ‘easy’ and highly profitable science that really produced widespread improvement in the standard of living, such as artificial lighting and widespread electrification. These ‘easy’ technologies have now been harvested, much as is the case, say, in physics. Newton could integrate physics and invent the calculus whilst sitting under an apple tree in Woolsthorpe. All he needed was his mind, and a considerable body of observation that required little technology, but a great deal of time and patience (both of which were at premium before the Industrial Revolution). Still, he did not require a large hadron supercollider, nor any other multimillion, let alone multibillion dollar infrastructure. Those days have largely vanished from physics; and from many other branches of science , where the ‘oil oozing out of the ground’ has been scooped up and sold. Science, like oil exploration, has had its easy pickings, after which point, discoveries get more difficult and costly to tease out of the natural world.

- This civilization treats scientists like garbage. I have written letters to the London Times and to The Guardian expressing my sadness and frustration that while there are countless statues to soldiers and generals – there are none to Darwin, Newton, Telford, Turing, or the countless other British minds that essentially enabled scientific-technological civilization. My suggestion to put a statue of Newton or Darwin on the Fourth plinth in Trafalgar Square (which is empty of sculpture or statuary) was rebuffed in a snide email from an editor at The Guardian who suggested that I “return to the US, and erect such statues in my hometown.”

All of these observations are, of course valid, and no doubt contribute significantly to the technological slowdown. However, as attractive as I find these ideas, they do not begin to adequately explain the current economic situation, nor do they really explain why we are all not a lot richer than we are. I say this because by any measure of actual increase in the efficiency of production, we should be much, much richer than we are. Cowen, in particular, makes the point that advances in computer technology have not really improved the lot of the average citizen in the West, in terms of real wealth. And he is right. What he is wrong about is why this is so, because clearly, if you actually visit contemporary factories, all you see is automated production – production that is orders of magnitude more efficient than were pre-computerized methods of production. So, the question that should be asked is, “Where did all that extra wealth go; if it didn’t go into the average citizen’s pocket?

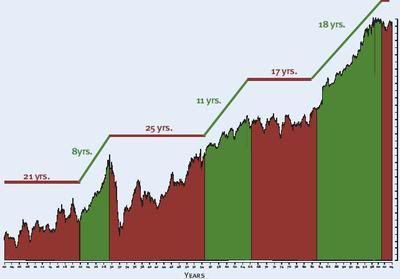

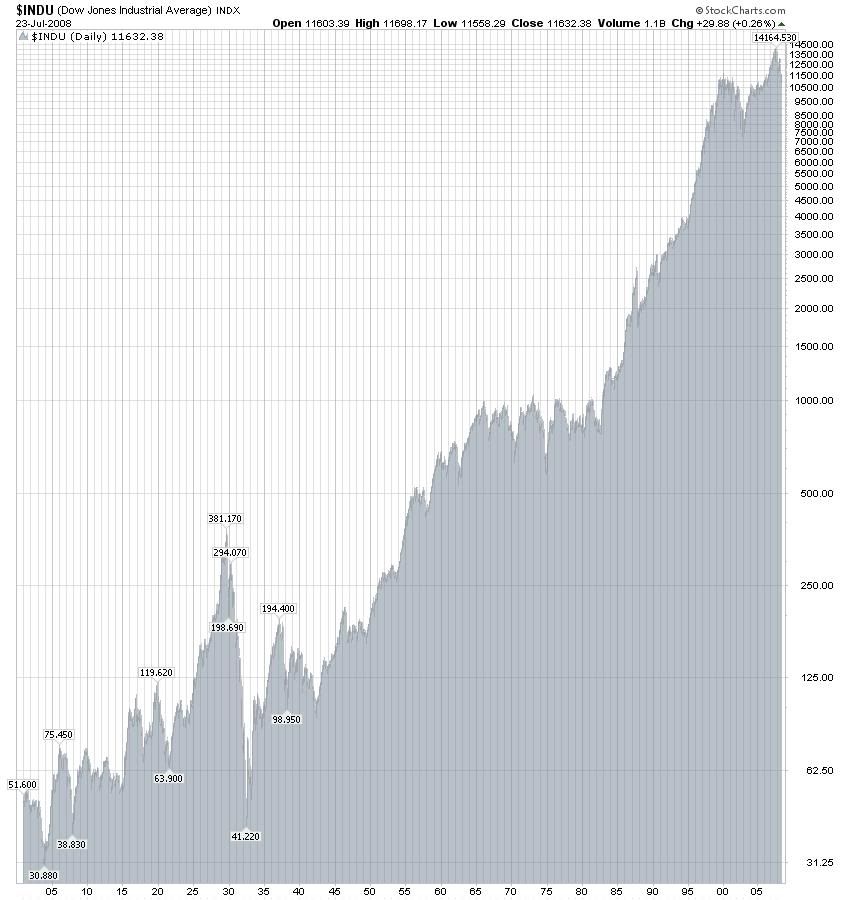

Below is a graph of the DJIA performance from 1900 to the present. It is how traders, investors and bankers like to look at the data, and if you look at it that way, you will be very reassured. In fact, no matter how you plot the data it confirms something very important: we (the West) have gotten richer as a civilization at greater speed than at any other time in human history (i.e., through productive means, that is, as opposed to violent conquest and pillaging).

Figure 7: DJIA average from 1900 through the present.

Figure 7: DJIA average from 1900 through the present.

You can also see this if you look at the per capita oil consumption as a marker of economic activity, and more arguably, productivity from 1900 through the present, not only in the West, but across the globe. We have gotten undeniably wealthier and at a seemingly impressive rate.

Figure 8: Oil Consumption in leading economies from 1990 to 2005.

However, these data are misleading, because they only shows the overall share value and the absolute energy expenditure, and they do not show it in relation to the overall wealth generated, or more importantly, to the fraction of that wealth that is retained by the people who really create it. For instance, look at the curve for Japan if you want to see the future for the US, and much of the rest of the world; gold-rich nations with little debt and little bad paper from the US and Europe, will likely be spared some of the worst of what is to come.

Determining how much wealth has been diverted is a tricky thing to determine, because you have to subtract out various kinds of parasitism, which is very difficult to do on an objective basis. For instance, governments do provide real benefits and services for their citizens; clean water, transportation infrastructure, law enforcement, the justice system, sanitation and public health, and so on. These things are costly and necessary. But how costly are they in both absolute and relative terms, and what is essential, and what is simply waste, theft, or bad decision making? This is really hard to know.

When I first got interested in this issue my perspective was very simplistic: historically nation-states (and empires) collapse when the taxation burden on their populace exceeds ~30% of the GDP, or its equivalent. So, it would seem simple enough to look at the taxation rate and come up with a number as to how close to that historical margin we are at any given time, assuming, of course, that this number still applies, because in the past, peoples’ incomes were just barely enough, or a little more, than was required to keep them alive, or in a modest (very modest by today’s standards) zone of comfort. When I was a child, people did not have a lot of chattels, and essential items like shoes or school clothes were costly, and they were socially a ‘big deal’ to purchase. I would estimate that 10 to 15% of the kids in my primary school had shoes with holes in them that they lined with cardboard. It was a working class neighbourhood, and money was tight. That situation has almost vanished from the West, and in fact, we export discarded clothing and shoes to the Third World by the millions of metric tonnes each year!

So, 30% taxation on total earned income almost certainly does not equal the breaking point for parasitic load today, because that breaking point probably represents the fraction of earned (and available) income you have to take from a population before they start to be acutely uncomfortable, begin to be unable to buy necessities AND become fearful about their prospects for long term stability, and even for their personal survival. The huge absolute growth in wealth has thus destroyed the utility of this at least 2,000-year-old indicator for predicting how much theft is intolerable to the continued functioning of the socioeconomic system.

Figure 9: Regulatory burden constitutes a form of hidden taxation – and if the funds are squandered that constitutes theft from the people who produced that wealth.

During the Nixon-Greenspan nightmare of wage and price controls that occurred as a result of inflation secondary to the Vietnam War and the Arab Oil Embargo and (a sharp rise in oil prices) in the early to mid-1970s, I was very concerned. I was only 18 at the time, and knew nothing about economics. However, I did know that the only way I got my second cryopatient frozen was by the expedient of his son bribing two people with substantial sums of cash to get access to petrol for the cars we needed to move about in, and to obtain aviation petrol to fly the Cessna (with the patient in it) from Cumberland, Maryland to Detroit, Michigan. Fuel was rationed by edict of the Federal government in 1973.

By1975 I had learned about the ~30% rule, and also learned a little about economics, having read von Mises (and discovered the ‘Austrian economists’), as well as Bastiat. I then tried to figure out how much taxation there really was. Initially, I was very reassured. But then, I realized something that I’ve not seen discussed elsewhere. The real extent of taxation was vastly greater than it appeared, because it was stacked, compounded and hidden in ways never before imagined, nor possible – indeed not even technologically possible – let alone socially acceptable.

I was buying a can of navy beans beans in the Alpha –Beta grocery store in La Crescenta, California one day in 1974 and I looked at the picture of the beans on the can and thought of home, back in Indiana. Farms, farmers…and then it hit me. The farmer pays property tax on his land, and that tax has risen sharply to pay for all kinds of government services unheard of in the past. The farmer also pays sales tax on every item he buys, both for personal use, and in many cases, for the conduct of his business. He pays a hefty tax on the fuel he uses to run his agricultural equipment, and of course he pays income taxes, social security taxes, and many use or permitting fees, as well. He also pays Social Security and income tax charges on his workers, as well as state Workers Compensation Insurance on each employee.

The farmer then sells his beans to agricultural wholesalers who have many of the same tax expenses, and the wholesalers in turn sells to the processors; who have even greater tax burdens, because they has many of employees, and a generally broader and deeper interface with commerce. And more transactions mean more opportunity for taxation. The retailer who puts the can of beans on his shelf has even more of these expenses, and he must advertise, as well, which is highly taxed (TV licenses, lots of employees, and on and on). Finally, I walk into the store, having paid my SSI, income tax, and countless use fees (driver’s license, road toll fees, professional licenses, and on and on) and I buy my can of beans and then I pay the California state sales tax that was, I think at that time, between 1% and 2% (again, that was in 1974).

I realized then that real tax burden was both vast, and either not calculable, or very difficult to calculate. Since 1974, sales tax in California has increased to 7.25%, and local supplementary taxes (city or county sales taxes!) are allowed up to 8.75%. The average is around 7.5%. But that is just the tip of the iceberg in the increase in predation on income since 1974, because since 1974, truly vast amounts of costly regulation and fees have been put in place at every level, and on every kind of economic activity. The biomedical research operations I’ve managed over the years are a case in point. We began to pay the following fees and charges starting around 1980, which we’d never seen before:

- Biohazardous Waste Disposal Permit,

- Hazardous Chemicals Disposal Permit,

- Disposal and in-house tracking paperwork costs associated with 1 & 2 above,

- Dead research animals were reclassified as biohazardous waste meaning we could no longer use rendering plants that paid us for the carcasses, but instead had to pay for costly and documented incineration by specialized providers with no economies of scale,

- Lawn sprinkler backflow prevention system and yearly validation fees,

- Knox Box installation (to allow fire-fighters 24/7/365 access to our building by essentially providing them with a key!),

- Hazardous materials and fire inspection fee,

- Annual fire sprinkler testing, validation, govt. Mandated maintenance and inspection fee,

- All contractors working in the city of Rancho Cucamonga now required to purchase a city business license!

10. Sharp escalation in Federal licensing fees for required permitting,

11. Imposition of state pharmacy board inspections and associated fees,

12. Imposition of the requirement that a tiny business (and others like us) have workers compensation insurance which we had to pay at the highest rate (nursing home because they could not classify us easily,

13. Huge increase in the cost of scientific and professional books because publishers and wholesalers were not allowed to carry over unsold inventory past the end of the fiscal year without paying property tax; you see the same thing with care dealers who MUST clear their inventory at their fiscal year end or pay taxes on all the cars they own sitting on the lot,

14. Enforcement (for the first time) of property taxes on all our of equipment and furnishings,

15. Requirement for building and planning permission for all construction of any kind; put in a sink, pay a huge fee plus the costs of the application, the professional drawings, and the city inspection after it is installed. Even non-load bearing simple devising walls or cutting a hole in wall to create a pass-through from one room to another required permitting and often inspection – all at a charge,

16. Countless new requirements that we use only certified or professional personnel in every area of operations from animal care techs (including the people who cleaned the kennels) to laboratory facilities and chemical suppliers used,

17. Total prohibition on the use of any expired product in animal research; this alone doubled our costs of carrying out experiments,

18. Required training for employees to prevent sexual harassment or other discrimination,

19. Explosion is costly signage requirements; we had to buy very costly signs to post sexual harassment laws, workers comp laws and employee rights, warnings to employees about defrauding workers comp, anonymous complaint system, lighted signs over all exits (thousands of dollars in wiring alone), countless safety signs (no mouth pipetting, caution slippery when wet, eye wash, first aid and safety signage,

20. All accessible pipes and cables had to be labelled at fixed intervals as to what they conducted and had to arrows showing the direction of flow; new construction had to be labelled before the walls were closed… Inspection of same for a fee.

I can’t even remember all of the fees, and if I did, it would run to many pages. Beyond these fees, there was the new practice of charging to any new construction or development, both ‘conditional use fees’ and infrastructure fees. So, for instance, if we wanted to put in additional parking spaces, we were told we would have to pay for installation of an electronic cross walk sign on the street corner 3 blocks away, at a cost of $11,000! Developers were told they had to pay for vast runs of city sewage or water pipe, or pay for sidewalks, stoplights, and other infrastructure formerly paid for by general taxes on everyone. Large projects, such as the local super Wal-Mart here in Yucca Valley, have been stalled for years; in this case because they want Wal-Mart to pay for an entire sewage/water treatment plant for the region (Yucca Valley, Joshua Tree and 29 Palms). This would then allow these cities to switch from septic systems to sewage; at which point the cities involved will charge each householder about $4,000 for the sewer line and require them to pay for a private contractor to hook it up to the household drains; roughly another $3,000 cost, on average.

All of the above is hidden taxation, and often represents theft, or the shifting of taxes from productive creation or maintenance of civil infrastructure to wasteful, or actually destructive (actively destructive) spending. By the mid-1990s, I reckoned that actual taxation on productivity was in the range of 60% to 70%. It simply was not obvious, because so much of it was hidden, and it was not felt, because the wealth being generated by increased manufacturing and data handling efficiency was so vast, that it was now possible for people to be very comfortable on what amounted to the leavings from their real productivity.

Figure 10: Computerized and automated manufacturing have greatly improved economic productivity; but where have the profits gone?

Figure 10: Computerized and automated manufacturing have greatly improved economic productivity; but where have the profits gone?

Most of the increased productivity, and the means to siphon it off, have come about as a result of technological advances in computing, information handling, telecommunications, and the automation of manufacturing. Despite these obvious and huge increases in the efficiency of the process of production, distribution and sales at every level, people did not work less than they had in the previous few decades; instead they worked a lot more.

As an example, all of the benefit accrued from not having to wash clothes by hand on scrub boards, starch them, hang them out to dry, take them down and iron them, and to not have to spend 4-hours a day preparing meals (mostly from scratch), or not going to the market every day because of refrigeration, freezing, and the development of ‘Twinkie-style’ food preservation technology (no more weevils in cereal or flour) was effectively wiped out when women had to go to work. Now, two incomes were required to maintain the same, or a lower, standard of living. Granted, people were getting fundamentally new types of goods and services. But even factoring in the increased productivity, they had to work much longer and harder than they previously did, to get the same basic standard of living. This was not possible in the past, because people already worked just about as hard as they could simply to maintain a subsistence (survival) existence. There was no ‘play’ in the system.

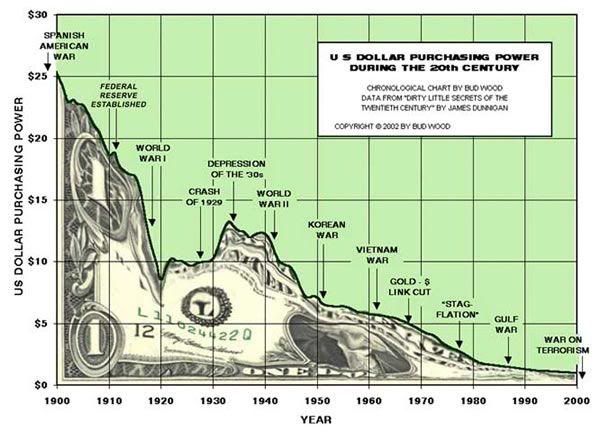

Finally, not considered was what was happening to the real value of the currency. The easiest and second oldest ways for nation-states to steal from their people is by ‘manipulating’ the value of the fiat currency they issue (the first way is taxes). Greenspan, evil genius that he was, cleverly manipulated the Federal Reserve so that inflation never seemed an issue. However, the real story was there for anyone who wanted to look for it to see, in the form of the decline in the real purchasing power of the US dollar, over time, as shown in Figure 3.

Figure 11: Purchasing power of the US dollar from 1900 to 2000.

I can’t (for the reasons just cited) show you the real fraction of wealth being taken from taxation in all its forms, but it is at least as great as you see above; and much of it is arguably addable to the loss in purchasing power from direct and indirect taxation.

Anyone with a picogram of commonsense, and who understands the laws of thermodynamics and the conservation of matter and energy on a practical, if not a theoretical level, knows that sooner or later something has to give; TANSTAAFL[1]!

What that breakpoint is (in objective terms, as the percentage of the GDP removed from productive use by the populace) and when it will come, is virtually impossible to predict. All that increase in productivity is fundamentally new, and it did change the paradigm. It changed the paradigm by allowing unprecedented theft of profits to go on at a higher percentage of the GDP, and for a longer period of time, than was ever possible in history before. Essentially what happened was that for the first time in history, the rate of increase in productivity more or less kept pace with the rate of increase of what can only be described as a historically unprecedented and savagely rapacious growth in the theft of wealth from its producers.

Arguably, critical care medical professionals are uniquely equipped to understand this, and then only ones who are older, who practice in the Third World, or visit and work there doing locum tenems. Historically, critically ill people died very rapidly. In fact, most people died in pretty good shape. I see this change reflected in cryonics from the time cryonics was first proposed in 1964, to the present. In the 1960s we used to get ‘high quality’ materiel in terms of patients. Cryopatients had mostly intact organ systems, mostly intact vascular endothelium, and were almost never massively oedematous: some congestive heart failure patients had oedema, but there simply were no ‘Michelin men and women’ (let alone Michelin children!). Application of externally imposed homeostasis now allows us to extend the dying process, such that survival is possible with levels of organ functioning so compromised, and systemic injury so severe, that these patients would have died long before they reached that state in 1964. We can do this because we have vastly better ‘half-way medicine’[2] and the vastly greater wealth to allow us to apply it. This is the perfect analogy for what has been happening in the current economy and it also directly responsible for some of the economic woe, both now and to come

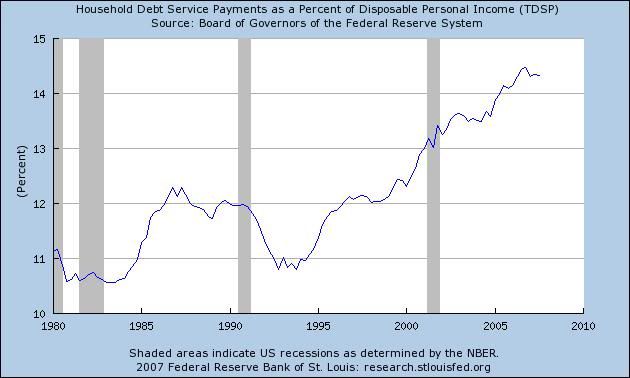

Around 1995 we went from a situation where increased productivity was keeping pace with increased theft, to the beginning of true ‘critical economic illness,’ which can be defined as the point at which you must start incurring debts to maintain homeostasis (e.g., early volume replacement by fluid resuscitation in the patient in shock). The graph below shows household debt in the US from 1980 through the present (projected to 2010):

Figure 12: Debt as a percentage of personal disposable (i.e., non-confiscated) income.

Figure 12: Debt as a percentage of personal disposable (i.e., non-confiscated) income.

What isn’t shown is that about 80% of this debt is now in the form of what is euphemistically called ‘short-term consumer debt,’ which is a very polite way of saying that the people who gave all these other people money, did so with NO SECURITY OR COLLATERAL! And, they did so without asking, “Why are these people borrowing all this money at such obscene interest rates, year after year?” The answer is, of course, because they need to borrow it in order to maintain what they consider an acceptable standard of living.

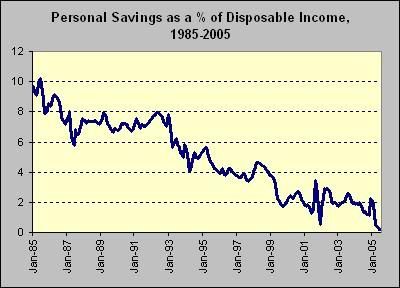

A good corollary point, also not considered, is that people don’t generally borrow money under such crummy terms, and in such large amounts, unless they have used up all of their other liquid or liquefiable assets. That this was the case is shown nicely (or horribly) in the graph of personal savings as the fraction of household income from 1985 to 2005 below:

Figure 13: Personal savings as a percentage of disposable income from 1985 to 2005.

In fact, in the late 1990s, as you can see from the graph above, consumers began to hit a wall in their ability to take on debt, and this was ‘damaging’ to the house of cards that is the economy. At that time the true short term (unsecured) consumer debt was probably (realistically) around a trillion dollars, and the banks who had lent all this money absolutely had to have those credit card payments coming in, and preferably a little late, so they could tack on extra fees, and keep the revenue stream healthy. Unfortunately, people were tapped out of ready cash. There is, however, the important fact to consider (if you are a disreputable banker) and that is that about 2/3rds of the nation’s wealth is in homeowner real estate. That’s right, 2/3rds of all the value of the nation’s savings is in real estate that people mostly own to live in, or to rent to others to live in.

I also note that a few months ago, the US, for the first time in its history, went to a net negative savings rate; in other words, all the ready capital is gone (including most of the easily accessible equity in real estate).

Thus, we see the extension of the same no-responsibility, no-collateral lending practices that operated with credit cards, extended to real estate, begin at just this time. However, even that is not sufficient when you have pretty well gutted the value and fundamental productive capability of your economy (i.e., you have almost no manufacturing, you have mostly service industries, and you are running an inconceivable and unsustainable deficit in trade). The solution was to convert all this debt into securities and debentures, and then find greater fools; in this case international banks and foreign governments who would buy this crap.

So, that $1.5 million home (whose price was driven up by a speculative frenzy enabled by ‘free and easy’ money for non-repayable loans) in an average neighbourhood in Orange County, California, is in reality owned by HSB, Deutschebank, Credit Suisse, China, the UAE, and who knows who else! And, not only is it not worth $1.5 million, it is (or soon will be) functionally worth NOTHING, because people have to be able to buy it – and that requires that they have both money and access to credit; and they will soon have neither.

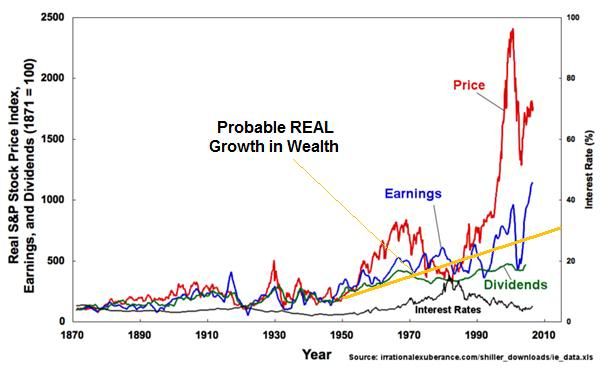

Figure 14: The incredible disconnect between price, earnings, dividends and probable real value of shares; and of economic wealth as a whole.

Figure 14: The incredible disconnect between price, earnings, dividends and probable real value of shares; and of economic wealth as a whole.

And that brings me to the stock market. Look at the graph of market performance from 1870 to a few months ago (Figure 14). Now, if you assume a fundamental increase in productivity over and above what has been the historical average, starting around 1950 (the effective start of computerization, improved telecommunications and a large scale switch-over to automation in industry and agriculture) and you evaluate the actual growth in productivity based on dividends, or even draw a line between dividends and earnings, you will see a truly terrifying disconnect between price and real wealth. I’ve illustrated this with a yellow line that shows the likely real historical slope at which wealth is increasing. And that rate of increase is certainly not what you see below. So, if you want to know how big the market correction is ultimately going to be, then the minimum is to between 700 and 900 of the current DJIA. It may be lower, because some of the value of the healthy parts of the economy, such as businesses which are currently sound, may be destroyed as a result of the fallout from lack of credit, lack of jobs, and consequently lack of money to buy goods and services.

What kind of cretin or fool could be persuaded that the real value of shares, real estate, or anything else in a stable, productive, non-speculative economy can increase by 70% to 80% in the time period from 1990 to 2008??? That would truly herald the arrival what another group of fools and idiots call ‘The Singularity’; a point in time (coming almost any day now, we’re told) where technological progress becomes, more or less, some large exponent of exponential! Belief in Singularities is common in people, because they certainly happen to individuals (windfalls) and to companies (Google). But historically, there is only one kind of singularity in technology, finance, and human civilizations, and that is the Negative Singularity, where a bubble collapses (tulips, the South Sea Trading Company, swamp land in Florida, hot stocks in the 1920s, or the Roman Empire).

Of course, government officials, stock brokers and bankers, don’t work lifetimes at their jobs anymore; they hop around like fleas from one dog to another. They might be able to hold five years of data in their heads, if we are lucky. But mostly, they exist in a world that endures only from quarter to quarter. I love that add from Scottrade on TV. I only remember one line from it, which goes something like “Our funds consistently outperformed the 5-year Lipper Average.” Five years is about it in the current financial world timescale. How long do you plan to be retired for, or to invest in your retirement, before you retire? Five years?????

Below are two graphs presented the way governments, bankers, stockbrokers and financial analysts like to present market data and, much more importantly, how they actually see the data in their tiny minds.

Figure 15: The DJIA data as the ‘wizards of Wall Street’ want you to see it.

These data look very reassuring, because they are log plotted over very short periods of time. They do not reveal that what is in fact happening is the metabolic equivalent of uncoupled oxidative phosphorylation; lots of oxygen consumption, lots of substrate use (consumer spending), lots of heat produced (high share prices) and ZERO net production of ATP (no real economic growth or true increase in share value). The net effect of this for cells and organisms is death, and this is also true for economies and nation states that operate similarly.

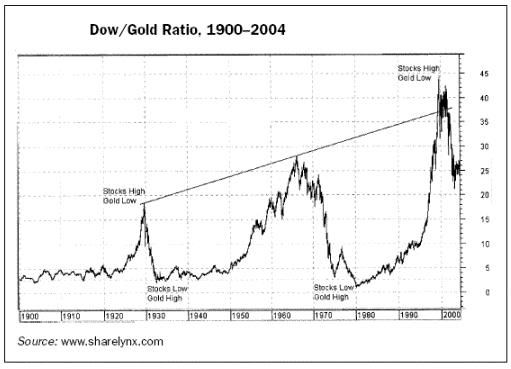

In humans (and other animals) who suffer this kind of uncoupling, the desperate response is to turn to anaerobic metabolism, which is inefficient, inconvenient, and wasteful. The economic equivalent occurs at the point where every single productive investment vehicle is deemed unsafe and unsound, at which point people stop trying to make money, and start trying to just hold onto it. They do this in the time honoured way of buying precious metals, usually gold or silver, or other commodities or shares deemed bulletproof. This is the last-ditched effort to conserve wealth, because it means that much easier, more convenient, and more socially acceptable ways to deal with economic instability, such as investing in real estate, or even government bonds with low (or in the case of Japan, essential no) interest rates, but presumably rock solid reliability, are no longer options. And, in looking at the Dow/Gold ratio as shown in the graph below, you see writ the final step in this decompensatory process, before Armageddon.

Figure 16: The Dow/Gold Ratio which is arguably the more asccurate indicator of the real value of stocks.

The naive optimist will look at this graph and say, “Well, look here, gold prices have been trending down since 2004.” Yes, on this graph that is true because if you want data from 2004 through the present, you have to pay for it. Gold is at historically high prices and, as of yesterday, I can’t even imagine what the Dow/Gold ratio is now!

The reality of this is can be seen if we look at the real stock market returns over the same period which shows the typical displaced to the right delay in reaction, but which nevertheless maps the reality of an increasing number of investors fleeing every other kind of investment to ‘speculate’ in gold and: there is only one thing worse than speculation in gold; and that is when it isn’t speculation anymore.

So what can we expect? The short-term answer is, “I haven’t any idea,” and the longer-term one is, “A prolonged period of sheer economic hell at least comparable in intensity to the Great Depression of the 1930s.” What form it will take and what its particulars will be are not within my ken.

However, I can tell you that two almost certain consequences of this will be the emergence of a new crop of Hitlers, Stalins and Maos, as well as profound changes in the social and political order in all of the world’s large nation-states; and in many of the smaller ones as well – there accompanied by violence and chaos.

For those of you with liquid assets, the only thing I can suggest is to shelter them as best you can. It is a certainty that the US Federal Reserve will act to protect personal savings, and to bail out core financial infrastructure at any cost. And that cost will be further debasement of the currency. This will take many months, or even several years or more to play out, but it will escalate sharply as confidence in the currency is lost, and there is further erosion of productivity, and greater demand placed on a limited supply of precious metals, and other value-retaining commodities.

To quote the Bard:

“There is a tide in the affairs of men,

Which taken at the flood, leads on to fortune.

Omitted, all the voyage of their life is bound in shallows and in miseries.

On such a full sea are we now afloat.

And we must take the current when it serves, or lose our ventures. “

Truer words were never spoken.

- Mike Darwin, 16 June, 2008

Afterword: Death and Expired Morals – the Primary Causes of Our Ruin

I don’t want to fail to acknowledge that there is “a whole lot of stealing going on” in the old fashioned sense of the phrase. There is, in fact, significant unjust redistribution of wealth within the economies of the West, and this takes many forms, the most obvious of which are the insane compensation packages and salaries now given to corporate management. With Steve Jobs being an example of a possible exception, managers have little to do with generating the wealth that the corporations they oversee produce. No corporate CEO is worth millions of dollars per year in compensation. In Jobs’ case, the bulk of his compensation has come from shares in the enterprise he founded, an enterprise which has returned value only to the extent that it actually performs in the marketplace – which again, under normal conditions, is a function of the desirability and performance of the goods and services that customers are willing to pay for. The so-called ‘Robber Barons’ of the late 19th century were piker’s compared to today’s insanely overpaid corporate thieves.

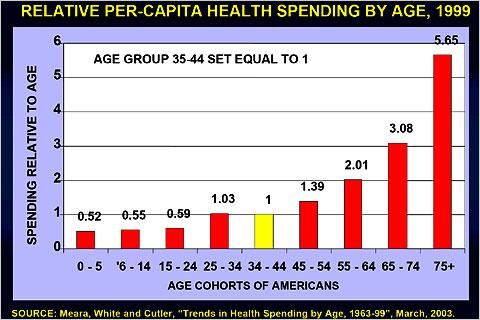

Figure 17: Health care costs as a function of biological ageing.

Figure 17: Health care costs as a function of biological ageing.

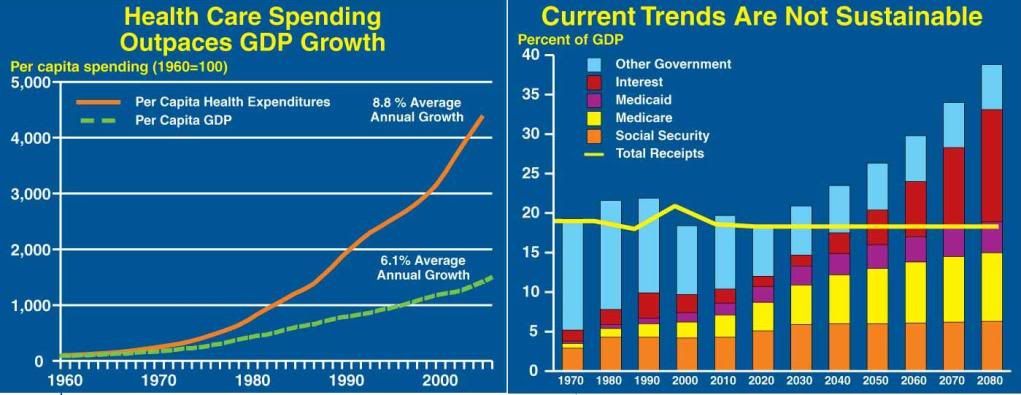

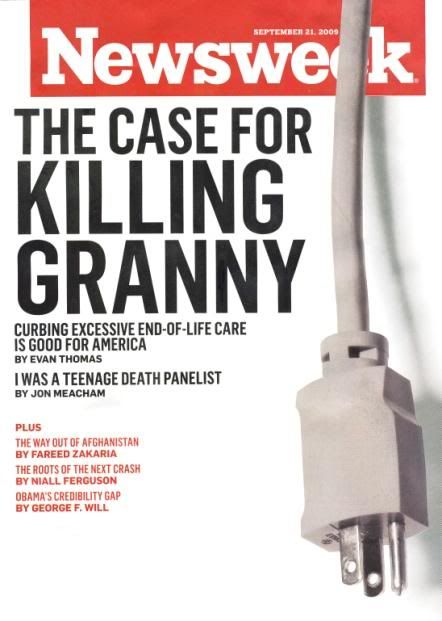

However, the real problems bankrupting us (and make no mistake – there will be no durable economic recovery), are an expired system of morals, a debased system of values, and the resultant infusion of an inconceivable and unsustainable fraction of our wealth into the machinery of death. Ironically, one of the biggest capital-consuming death machines is the healthcare industry. No doubt, that will come as a shocking and counterintuitive statement to many, but is nonetheless a hard reality, and an artifact of our ‘halfway medical technology’, a kind of medicine first identified by the physician-author Lewis Thomas in 1974:

“Halfway technology represents the kinds of things that mustbe done after the fact, in efforts to compensate for the incapacitatingeffects of certain diseases whose course one is unable to dovery much about. By its nature, it is at the same time highlysophisticated and profoundly primitive… It is characteristicof this kind of technology that it costs an enormous amountof money and requires a continuing expansion of hospital facilities…It is when physicians are bogged down by their incomplete technologies,by the innumerable things they are obliged to do in medicine,when they lack a clear understanding of disease mechanisms,that the deficiencies of the health-care system are most conspicuous…The only thing that can move medicine away from this level oftechnology is new information, and the only imaginable source ofthis information is research. The real high technology of medicine comesas the result of a genuine understanding of disease mechanisms andwhen it becomes available, it is relatively inexpensive, relatively simple,and relatively easy to deliver.” —Lewis Thomas[3]

Figure 18: At left, rapidly diverging and increasing growth in the cost of health care relative to the GDP, and at right, the absolute costs of health as a fraction of the GDP from the 100 year period from 1970 to 2070. Under no foreseeable circumstances is either trend sustainable.

The problem with halfway medical technology is that it doesn’t really work in the presence of aging and progressive degenerative disease. To try to treat such conditions without curing them is to experience exponentially greater costs, with comparably lower rates of return. In the parlance of auto ownership, it is to possess a car that has become impossibly expensive to maintain, and has thus become a ‘junker.’ Such cars are, of course, sent to the scrap yard. In medicine there is a name for this too: euthanasia.

At present, roughly 2/3rds of every healthcare dollar is spent in the closing decade of life, and perhaps as much as 60% of that expenditure is to pay for futile attempts to prolong the lives of clearly moribund patients – in other words, money spent in the last year of life. Not only is this a very unrewarding expenditure of resources for all involved, it is also not sustainable

“In the parlance of auto ownership it is to possess a car that has becomes impossibly expensive to maintain, and has become a ‘junker.’ Such cars are, of course, sent to the scrap yard. In medicine there is a name for this too: euthanasia.”

“In the parlance of auto ownership it is to possess a car that has becomes impossibly expensive to maintain, and has become a ‘junker.’ Such cars are, of course, sent to the scrap yard. In medicine there is a name for this too: euthanasia.”

Currently, US health care costs are consuming a staggering 16% of the GDP! This is up from 12% of the GDP in 2008! These expenditures are not sustainable, and what is more, they represent the expression and use of a moral system that has expired, and long ago began to sour. The position of cryonicists that individual human lives are invaluable and worth saving, not just ‘temporarily,’ but indefinitely, represents the new and proper moral position for the technology we now command. Nothing can be done to save the lives of those of us who have exceeded the reach of our current, mostly halfway, medical technology – not even at the price of bankrupting the economy of the entire Developed world: Nothing, that is, with exception of the development of reversible brain cryopreservation. Only by creating an enabling technology that allows patients – all patients – who have exhausted current medical technology, to continue their journey to a future committed to rescuing them, will work. The only alternative is to turn our hospitals and extended care facilities into death camps that will operate on a scale that would shame and humiliate Mao, Stalin or Hitler.

We know that this is so, but unfortunately, they don’t, and they aren’t about to figure it out anytime soon. To develop reversible brain cryopreservation for humans would consume a trivial sum, compared to what is spent on delivering even a single futile halfway medical technology, such as caring for patients with end-stage Alzheimer’s disease for a single year. And yet, it won’t be spent. And if such technology were developed tomorrow, it would not be used. Regrettably, we are much further off from any reasonable prospect of developing reversible whole-body suspended animation, by cryopreservation or any other means – something that the brighter bulbs in this civilization might be able to accept and embrace. Thus, the die is cast, and the system will crumble, or be transformed in ways that are unthinkable to any feeling person who values individual human life. We must organize and prepare ourselves for this almost certain eventuality, and do what we must to ensure we do not succumb to the carnage, as well.

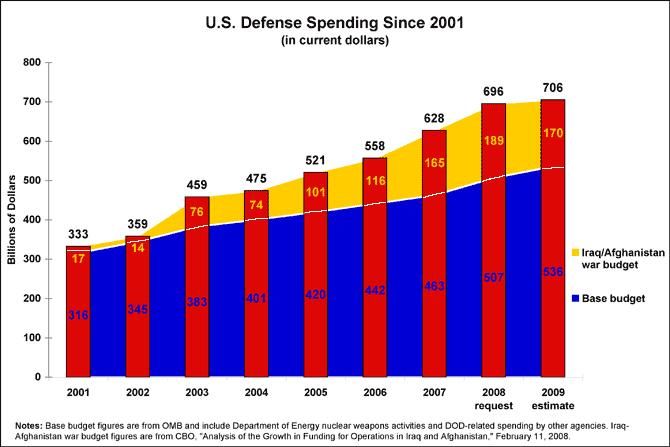

Figure 18: US military spending in current (2011) US dollars.

Figure 18: US military spending in current (2011) US dollars.

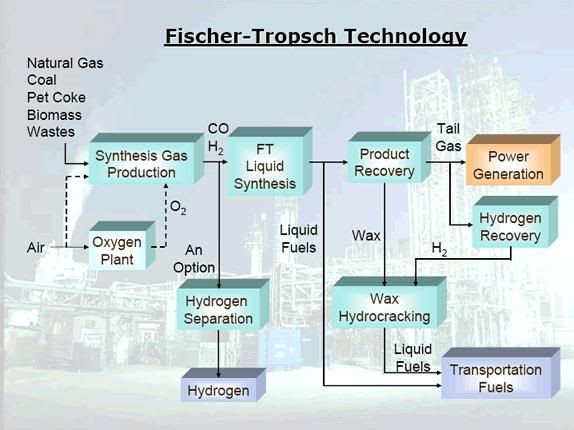

If you are wondering where a large fraction of the rest of the death machine’s operating dollars come from, look no further than to military expenditures. I am no ‘kumbaya singing pacifist,’ but these expenditures are insane, and they were completely avoidable. Had the US decided to construct Fischer-Tropsch plants at the start of the Arab Oil Embargo in the 1970s, to produce diesel from coal, cut back on wasteful energy consumption, worked to develop technologies for extraction of natural gas from shale, and made a commitment to continued large scale development of nuclear power (with ongoing research into Tokomak, and other fusion power research) there would be no Arab-Islamist threat today and there would have been no 9-11. We made these vipers rich with our intellectual and cultural capital – as well as our currency. We empowered them. Without Western, and in particular US petrodollars, the Middle east would be as it has been for the past ~1,500 years: an impoverished and insignificant pocket of mendacious people with a poisonous ideology.

Figure 19: Schematic of basic Fischer-Tropsch fuel generating process.

The Fischer Tropsch process (FT) was developed by Franz Fischer and Hans Tropsch, working at the Kaiser Wilhelm Institute in the 1920s, in response to Germany’s crippling inability to get access to petrol during the end of World War I. When Germany lost access to imported oil during World War II, the FT-process was used by the Nazi government to produce substitute fuels. F-T production accounted 25% of the automobile fuel used in the Third Reich, with technology that is now 70 years old![4] The largest implementation of F-T technology in the world today are the plants operated by Sasol in South Africa. South Africa, like the US, has large coal reserves, but virtually no oil, and with the imposition of anti-apartheid sanctions, South Africa had no choice (so long as it wished to continue apartheid), but to develop a means to produce liquid hydrocarbon fuels from coal. This they did, and with enormous success, and they are now, and have been, independent of Arab oil. [Sasol, the South African FT fuel production company, uses coal (and now natural gas) as feed-stocks and produces a variety of synthetic petroleum products, including most of the country's diesel fuel.]4

The whole sorry mess of the seemingly endless ‘ongoing crisis in the Middle East’ was thus avoidable. If we had but had the foresight, and the supporting structure of morals and values to take the responsible course of action, in response to the extortion that was the Arab Oil Embargo everything would be different today. In October of 1973, the members of the Organization of Arab Petroleum Exporting Countries (OAPEC) proclaimed an oil embargo “in response to the U.S. decision to re-supply the Israeli military” during the Yom Kippur war. This embargo lasted until March 1974.[5] As a consequence of the embargo, oil supplies were severely disrupted, and a deep recession was triggered througout the Developed World. Another consequence of the embargo was a serious fracture within NATO, which resulted in costly expenditures in foreign aid and defense spending. The unacknowledged price of the embargo was that the US had ‘caved’ by continuing to buy oil from OAPEC thus allowing the Arab states to increasingly determine global oil prices by arbitrarily controlling supply at critical points in time. A corollary of this was that OAPEC also now had a significant voice in determining US, and thus Western, foreign policy.[6]

The idea that the moral choices this civilization has made are at the root of our current predicament, and are very likely to cost all of us our lives if not reversed, is one causes of the fatal trajectory we are on. The second, and corollary cause, is that the core values of this civilization are at once deathist, and bankrupt. These are ideas that we will be exploring here in the near future. And not just exploring, but proposing viable alternatives to – alternatives that express the values and ideals of a cryonics movement about to be reborn.

The idea that the moral choices this civilization has made are at the root of our current predicament, and are very likely to cost all of us our lives if not reversed, is one causes of the fatal trajectory we are on. The second, and corollary cause, is that the core values of this civilization are at once deathist, and bankrupt. These are ideas that we will be exploring here in the near future. And not just exploring, but proposing viable alternatives to – alternatives that express the values and ideals of a cryonics movement about to be reborn.

- Mike Darwin, 08 February, 2011

[1] There Ain’t No Such Thing As A Free Lunch.

[2] The physician Lewis Thomas described it in this way: “Halfway technology represents the kinds of things that mustbe done after the fact, in efforts to compensate for the incapacitatingeffects of certain diseases whose course one is unable to dovery much about. By its nature, it is at the same time highlysophisticated and profoundly primitive… It is characteristicof this kind of technology that it costs an enormous amountof money and requires a continuing expansion of hospital facilities…”

[3] Thomas L. “The technology of medicine.” In: The Lives of a Cell. New York, NY: Viking Press; 1974:31–36.

[4] Leckel, D. Diesel Production from Fischer−Tropsch: The Past, the Present, and New Concepts. Energy Fuels, 2009, 23 (5), pp 2342–2358. DOI: 10.1021/ef900064c Publication Date (Web): April 16, 2009

[5] How We Got Here: The 70’s the Decade That Brought You Modern Life–For Better or Worse. New York, New York: Basic Books, 2000. p. 318. ISBN 0465041957.

[6] Licklider, R. ”The Power of Oil: The Arab Oil Weapon and the Netherlands, the United Kingdom, Canada, Japan, and the United States”. International Studies Quarterly (International Studies Quarterly, Vol. 32, No. 2) 1988;32;(2):205–226, [p.206]. doi:10.2307/2600627. http://www.jstor.org/stable/2600627.

What must now be understood is that collectivism, with respect to intellectual property (the real font of all wealth and progress) is many orders of magnitude more destructive than it is when applied ‘only’ to the means of production.

Please clarify. What exactly is collectivism with respect to intellectual property?

Also, I’m not getting the connection between the increased wealth of certain Middle Eastern countries and anti-Western terrorism. An event like 9/11 certainly did not cost more than a few million dollars and seems to have been prompted mainly by a dislike of United States foreign policy, including the invasion and near destruction of Iraq, the propping up of various hated pro-Western “leaders” with bribes (aka “foreign aid”) and the generous checks handed out to Israel from the United States taxpayers.

It is a sad joke that innovators are compensated for their ideas in any meaningful way. Ironically, the more fundamental and vitally important an idea is to a civilization, the less likely its discoverer is to be paid for it. If you invent a little centrifuge for getting the water out of lettuce or salad greens, you have some (small) chance of being paid for it. If you invent a novel integrated circuit while in the employ of a major IC chip manufacturer, you will certainly be paid – your salary, and if you are fortunate, a bonus. Innovators typically have to sign over all rights to all intellectual property (IP) they develop, to the company that employs them. In fact, in many, if not most corporations that employ people to generate IP, you must even get permission (or negotiate) to patent or author works that are outside of the sphere of your employment!

Now let us examine the case of someone who really does something valuable for civilization, like, say, figure out the Inverse Square Law or discover that E=Mc2. They get NOTHING. If they choose to write their work down, they may get the royalties from the book they publish. But, if they are in the employ of a corporation or university in the course of making their discovery, they may not even get that! Consider Isaac Newton: the question of why planets move in ellipses had come under discussion in a London coffee house, and Hooke boasted he could easily answer this question. A young astronomer named Edmund Halley mentioned this incident to Newton, and Newton casually replied that he had solved that problem quite sometime ago. And indeed he had. When Halley saw what Newton had done, he realized, more or less, that Netwon had effectively integrated physics: he had done for physics what Darwin did for biology with Natural Selection.

However, Newton had not the slightest interest in publishing his work and in fact, he was very much opposed. Newton was not a pleasant man and he was also not easily swayed. Eventually, Halley prevailed and the first volume of the Principa Mathematica was published. Newton’s thanks for this was rancorous criticism from Hooke, and from a sizable assortment of idiots and fools. One particularly dogged cretin, a man named Linus, deluged Newton with correspondence and harangued him in the press until he (Linus) died. Understandably, Newton refused to publish the second volume of the Principa. Arguably the only reason he did, was that Halley, whom he liked, would have been bankrupted, since Halley was obligated to the publisher, not Newton. If not for this rare act of kindness on Newton’s part the second half of the Principa would not have been published. And if not for Halley, none of it would have been published – and Hooke was lying when he said he had the answer. So, who knows where that would leave physics – 1,2 or maybe even more generations behind? Thus, the more powerful and durable an idea is, the less likely its innovator is to be compensated for it. In fact, the inverse is the case. Anything truly important or revolutionary, will inevitably threaten or anger people – often important people. That is almost always a seriously unpleasant thing to do. There is thus a strong negative incentive to do something new, and that incentive increases (probably logarithmically ;-)) as a function of how fundamental the idea is.

Ideas are immortal in principle – they are ‘information beings’ like you and I. When they become instantiated in matter is when they typically become valuable to civilizations (past and present). So, E=Mc2 may get you a dinner invite to a party hosted by nerds, but it is the hydrogen bomb that will give you the real bucks for your bang. The problem with this, is that people who make things from ideas get all the money. Not only isn’t that just, it is often wickedly counterproductive, because not infrequently entrepreneurs have very little emotional, or other investment in the ideas they profit from. I would not be surprised if the first chair collapsed when someone sat on it – after which, it probably took another generation for the idea of a chair to be rehabilitated. This disrespect for ideas and innovators exists at all levels in this civilization and it is incredibly corrosive. It is demoralizing for the innovators to see other men become rich from the fruits of their labors and have the gall to hold the innovators in contempt. And this happens quite a lot, because deep down, people who steal from other people usually feel bad about it, and as it turns out, one of the best ways to deal with that situation is to denigrate your victim. Thus, it is common to hear someone who makes things (and makes of lots of money from selling them), make remarks such as, “He may have had the idea, but without my entrepreneurial/manufacturing, or other skill, that idea would have been useless…” Sure, you try that on for size!

It is very well established what happens when we treat people who make things in this horrid fashion: they cease making things. It should be equally apparent that when we treat the people who make the ideas that make the things possible, they too will behave in the same way.

As to “the connection between the increased wealth of certain Middle Eastern countries and anti-Western terrorism,” that is pretty straightforward. If the US had pursued and achieved energy independence in response to the oil embargo, there wold have been no invasion of Kuwait by Iraq. Kuwait is a filthy rich little duchy, of largely Western creation (including its borders) which would not exist but for (largely) US petrodollars. Maybe China would have fought the Gulf War, but we would not have. In which case it would have been China’s jetliners plowing into Chinese skyscrapers. More to the point, it is petrodollars, and the sudden influx of wealth, that has caused Islamic Fundamentalism to become anti-Western and militant. This is because the money created all kinds of opportunities that threaten their culture (which is essentially their religion and their law). No money = no threat and also = no costly Western educations for the likes of Osama bin Laden. And it was the Western education that gave bin Laden the complex technical knowledge he needed to do what he did. Again, there is this problem of mistaking money and things for having the power of ideas. Yes, it was very little money that was spent to carry out the 9-11 attacks. But it was a brilliant and analytically trained mind that executed them – a mind also filled with poisonous ideology, and one that had been stressed, repeatedly, by the incursion of ‘infidels’ into his sacred homeland (first the Soviets, then the US). Remove the value of the oil, and Arab world has nothing the US wants so badly as to send troops into harm’s way in that godforsaken neck of the woods. Bin Laden didn’t even have to leave Saudi Arabia to get his Western education because petrodollars paid for the exclusive King Abdulaziz University where he matriculated – a university whose faculty consisted of, you guessed it, Westerners and Western educated Arabs. Sigh.

I find arguing counter-factuals to not be very productive as there very often simply is no way to prove anyone is either right or wrong. One can’t run an experiment in an alternate Universe where U.S. government policy was different. Yes, you can make statements like “I wouldn’t exist if my parents never met”, but that’s are far cry from predicting what might have happened if, say, Oswald had missed his shots or if Hitler had died in 1931.

What changes would you like to see to make sure people who come up with useful ideas are better rewarded for their work? You appear to be suggesting that Einstein, for example, should have received more financial reward for thinking up E=MC2. But how?

Sure, you can, as I’ve said here, spend all your time in an exercise of mental masturbation asking, “What if?” about all of history. It is similarly possible to do the same thing when considering your personal past, and there are people who, sadly, spend all their time in an angst ridden state, fretting over whether they did the right thing, or not, in every situation, and asking endlessly, “What if I had…” That’s a very destructive way to live your life, and it isn’t instructive about anything, save that such indiscriminate over-analysis is a bad thing.

However, there are situations, both personally and historically, where asking, “What if?” is not only productive, it is essential to survival and success. In the personal sphere, it is , in fact a very good idea to ask questions such as, “How would my life be different if I hadn’t gotten into that car drunk, and subsequently mowed down a group of people waiting for the bus?” Indeed, even more complicated “What ifs,” that approximate the historical example under consideration here, can be very useful. And here’s an instructive personal for instance: “What if, in 1981, when I was designing the management mechanism for Alcor, I had been more knowledgeable, less cocksure, more reflective, and sought more advice, instead of proceeding to make the Alcor Board a self-reelecting machine, free from almost all member feedback, save that of people voting with their feet? How would, or even how might, things be different today?” It is certainly true that crying over spilt milk, as an isolated exercise, is not productive. However, if by asking “What if?” I get alternative scenarios that are genuinely useful for the future, well then, that’s an exercise well worth undertaking.

In the case I’ve just used, my answer would be that, while my intent was good, namely to create a highly stable management that was all but invulnerable to take over by an influx of pseudo-cryonicists (of which there are a rapidly growing number), a far better strategy would have been to apply a vetting mechanism, whereby cryopreservation members could not vote until they had been members for, say, 3 years, and then voting might be restricted to half of the Director positions. Other schemes are, of course, possible, such as having different levels of membership, based on performance milestones in terms of knowledge and service to the organization, as well as time spent as a member in good standing. Thus, for instance, people who had completed training sessions, or engaged in otherwise useful activity that also educated them about the realities of cryonics and Alcor, might be granted additional voting authority. This could have been done: Alcor was very small, had no assets, and if it wasn’t permitted in one state, it could have been reincorporated in another. It’s true that there is no way to know with any certainty how things would, be different, if this course of action had been followed. But it is plenty good enough, in this case, to know that in all probability they would be better.

So, now we come to the specific question you ask about how to deal with the problem of compensating innovators for their innovations. The short answer is easy: “Start paying them!” This can be done in many different ways, depending upon the situation. The Entertainment Industry uses mechanisms like ASCAP, and the various other music and video registration sites. Thousands, if not millions of people, think they can sing, or that they have written music that the world will pay to listen to. It matters not if their music is terrible, or brilliant. They register their work with the IP domain, and when people use their ideas, the innovators get paid. How much they get paid, and how they get paid are often complicated details, but the point is, they do get paid. As a consequence, we have people like Madonna, Michael Jackson and Susan Boyle becoming multimillionaires for crooning. That’s fine, up to a point, because people will only pay for things they want, and what they want depends upon how closely their value systems match what’s really good for their survival. The fact that McDonald’s, and other fast food franchises are fantastically wealthy, or that the cigarette industry continues to thrive, says nothing about the wisdom of the consumers who made them successful. A major flaw in capitalist theory is that all customers are created equally, and that what the market place wants is always good for it. If you have a garbage-in problem on the decision making end of the market equation, you’ll have garbage-out problem on the other end, as well. It’s the same with democracy, where the assumption is that an uneducated, philosophically and morally bankrupt population, will make the same voting decisions as an educated, long-term oriented, and thoughtful one. It’s the same error, in reverse, that I made with Alcor in 1981.

Do I have all the answers? Will any system so designed be absolutely perfect, or absolutely just? Of course not. But establishing IP registration sites and establishing a compensation scheme, ANY compensation scheme, is an absolutely essential first step. Corporations could (and should) also recognize that money is not superior to ideas, let alone that it has the only vote. So, for instance, in a business that depends upon the generation of IP for its existence, the innovators, and especially the innovator-entrepreneurs, should be compensated for their IP input, on par with the capital input from investors or over par.