By Mike Darwin

Figure 1: Cryonics, a bridge to tomorrow, or snow choked catastrophe in the making?

Failure: What is the Really Big Risk?

What I have had to say in the four articles in this series to date has been almost exclusively failure analysis, or put less delicately, criticism. While good criticism isn’t easy, it is unarguably a lot easier than proposing solutions, and more importantly, solutions that are at least worthy of consideration, if not demonstrably practical. The inevitable first response that occurs when a course action other than the one those currently (and for a long time now) in control of cryonics organizations are committed to is to say, “That’s all very and good, but we can’t afford it! We are barely making ends meet now, and we constantly have to increase charges to members and beg for more money.”

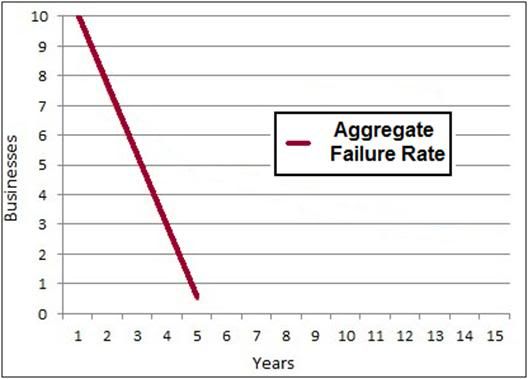

Thus, before considering existential risks and other positive changes in priorities in detail, I will need to consider other more mundane, but likely much more serious risks to the failure of cryonics, some of which appear to be upon us, or nearly so, even as I write these words. Because we never undertook any serious and systematic risk analysis for failure in cryonics we now find ourselves confronting the most common and the most mundane risk of failure of all: organizational failure. Most new business undertakings, regardless of whether they are profit or nonprofit, tax exempt charities or hard driven efforts to make a large financial gain, fail within the first 5-10 years of start-up. Viewed in this light, the “high” failure rate of the relatively (and absolutely) very small number of cryonics enterprises that have existed over the years is not extraordinary; it is par for the course (Figure 2).

Figure 2: While it is well known that most start-up businesses fail, the uniformity of that failure is generally under-appreciated by members of the general public. Historically the rate of start-up failure in the US has been in the range of 98%, however, since the 1940s this has declined to ~5% of all new business enterprises.[1]

Figure 2: While it is well known that most start-up businesses fail, the uniformity of that failure is generally under-appreciated by members of the general public. Historically the rate of start-up failure in the US has been in the range of 98%, however, since the 1940s this has declined to ~5% of all new business enterprises.[1]

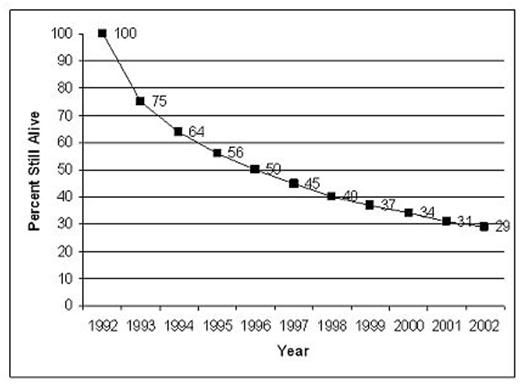

What is assumed is that after this brief initial period of high mortality, businesses that do survive experience a far lower failure rate. This is, in fact correct; those few enterprises that survive gradually absorb the market sector and human and capital resources of the many who fail. However, as can be seen in Figure 3, if we “re-set” the graph at 5 years, and then follow the remaining cohort of enterprises out to the 10 year mark, the mortality rate is still quite high with only 29% of businesses surviving.

Figure 3: Failure rate of start-up businesses in the US over the ten year period from 1992 to 2002.[2]

Figure 3: Failure rate of start-up businesses in the US over the ten year period from 1992 to 2002.[2]

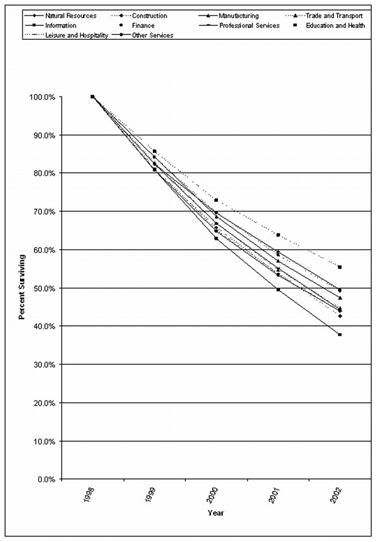

There is also surprisingly little spread between business types in terms of 10 year survival as can be seen in Figure 4; the difference between sectors is ~ 20%.The shortest surviving businesses are those offering leisure and travel services and the longest surviving are those engaged in providing education and health; with manufacturing falling about midway between these two.

While the general public may not have a good grasp of these numbers with precision, it would strain credibility to assert that they do not have a general feel for the volatility and the short lifespan of most business enterprises. In fact, the older and more experienced the individual is, the more reasonable it would be to assume that his understanding of the ephemeral nature of enterprise is improved. It is thus quite possible, if not likely, that an underlying reason for the lack of credibility of cryonics in that segment of the population most likely to find it desirable is that that same cohort has the most experience with and understanding of the improbability of the very long term (i.e., 100-200 years) survival of any human enterprise. As many scholars and pundits alike have noted, with the exception of the Roman Catholic and various branches of the Orthodox Church, few if any institutions have continuously endured for millenia. Similarly, institutions that have endured for may centuries, such as universities (Oxford and Cambridge come to mind) are typically creatures of nation-states – the other class of entities that have shown endurance in the millennial range. In short, corporations, including NPOs, are almost exclusively short lived creatures that fill a market niche, do their business and then die.

In 2009, the Japanese business analysis and survey firm Tokyo Shoko Research (a combination of Dunn and Bradstreet and TRW in Japan), conducted an examination of the founding dates of the 1,975,620 enterprises in their database.They found 21,666 companies which have existed for over 100 years. The Bank of Korea conducted a similar evaluation of their database and found that there are 3,146 firms founded over 200 years ago in Japan, 837 in Germany, 222 in the Netherlands and 196 in France. There are 7 companies in Japan over 1,000 years old; 89.4% of the companies with over 100 years of history are for profit businesses. However, a closer examination of the history of these long-surviving enterprises reveals that many underwent takeovers, buyouts and essentially a complete restructuring of mission and the nature of the business the firms were engaged in – often more than once in their history. Thus, the chances of a business entity (excluding religious and academic institutions) surviving for >100 years is 1.096%.

.  Figure 4: Survival of business enterprises in the US by type of business.[2]

Figure 4: Survival of business enterprises in the US by type of business.[2]

In recent years there has been increased attention paid to why businesses experience such a high failure rate, and in particular why the early mortality is so punishingly high.. There have been a number of academic studies, as well as a variety of failure analysis books written by businessmen and assorted “consultants” and “gurus” offering tip and techniques for avoiding failure.[3-5]

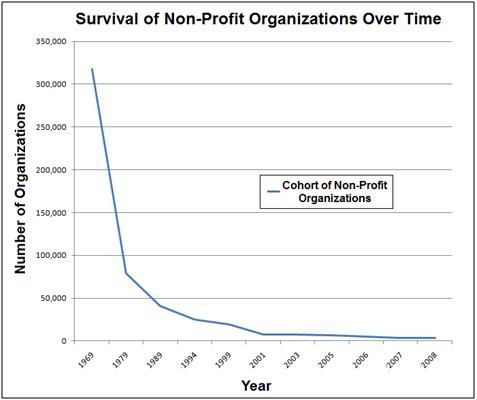

Of considerably more relevance is how 501c3 non-profit organizations fare over time. Figure 5 shows the aggregate survival of non-profit organizations (NPOs) as a cohort from 1969 to 2008, a period of nearkly 40 years. Whilst the early mortality rate is high, it is not nearly as high as is the case for for-profit organizations. NPOs experience heavy mortality over the first decade, with the rate of failure slowing considerably over the second decade of life. However, by the 30 year mark, ~95% of NPOs have failed. The data presented in Figure 5 are probably unrepresentative of what lies ahead for US 501c3 NPOs in the near future, because the number of these organizations has grown from 464,138 in 1989 to 819,008 in 2000 – a doubling in a little over a decade. Not surprisingly, the high rate of failure amongst NPOs is now occurring in part because of the current severe economic Recession, but also because of the entry into the NPO marketplace of a broader cross-section of the population with less experience in the founding and operation of charitable organizations, or indeed businesses of any kind.[3]

Figure 5: Survival of US 501c3 non-profit organizations (aggregate) from 1969 to 2008.[6]

Figure 5: Survival of US 501c3 non-profit organizations (aggregate) from 1969 to 2008.[6]

Many reasons exist for the high mortality rate in businesses both initially and over time. There are many “top 10,” “top 7” and” top 5″ lists of reasons given by various pundits and advisers. In the case of NPOs, some of the most commonly cited causes are shown in Table 1.

Consistently near the top of most lists of reasons for the failure of NPOs are dysfunctional management and failure to maintain and file adequate financial records. In recent years there has also been increasing focus on the criticality of the NPOs’ boards of directors to the success or failure of the organizations.[3, 7-9] In 2003 Judith Miller reported on her extensive longitudinal study of the boards of 12 non-profit organizations. She discovered that there were two primary factors that determined how effective NPO directors were at discharging their duty to monitor and intervene in the action of their NPO. The first of these factors was how the individual board members defined their relationship with the CEO and how well and how well they understood the scope of their monitoring function. Her findings also demonstrated that, given ambiguous rules of accountability and unclear measures of performance, NPO board members tend to monitor in ways that reflect their professional or personal competencies, rather than paying attention to measures that actually indicate progress toward the mission-related goals and initiatives of the organization; and thus of its success or failure. And of course, the degree of commitment and the seriousness with which the directors undertook their monitoring function was also critical.[9]

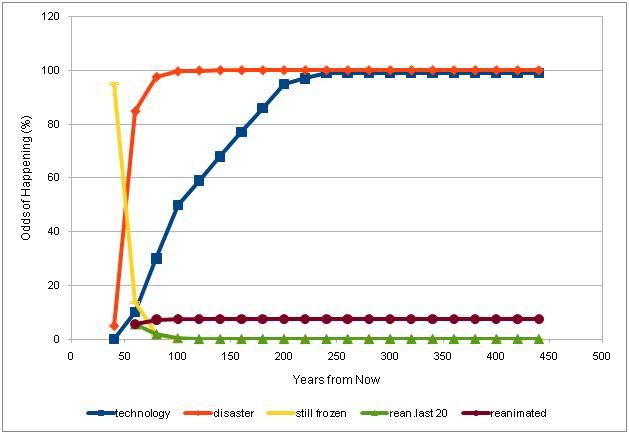

Figure 6: Using the “Cryonics Calculator” developed by Brook Norton (http://www.cryonicscalculator.com/), and assuming a very conservative risk of organizational failure of 30% for the first two decades of cryopreservation, 75% for the second 20 year interval, 10% for the third 20 year interval, 3% for the fourth 20 year interval and 2% for last 20 year interval the probability of being recovered from cryopreservation is only 17%. [This assumes that you are currently 50 years old and will be cryopreserved at age 90 and that you have a 5% risk of autopsy, or other catastrophic destruction of your remains prior to cryopreservation.]

Figure 6: Using the “Cryonics Calculator” developed by Brook Norton (http://www.cryonicscalculator.com/), and assuming a very conservative risk of organizational failure of 30% for the first two decades of cryopreservation, 75% for the second 20 year interval, 10% for the third 20 year interval, 3% for the fourth 20 year interval and 2% for last 20 year interval the probability of being recovered from cryopreservation is only 17%. [This assumes that you are currently 50 years old and will be cryopreserved at age 90 and that you have a 5% risk of autopsy, or other catastrophic destruction of your remains prior to cryopreservation.]

Using a very simple model of the impact of institutional failure on the chances of recovery from cryopreservation and (approximately) applying the historical NPO failure rate data shown in Figure 5, the chances that a person will be recovered from cryopreservation over a 100 year period of storage are only 8%. This outcome does not consider other risks, such as government proscription of cryonics or existential risks such as fire, flood, earthquake, pandemic disease, etc. Very importantly, it does not take into account the probability that existing cryopreservation procedures may not be sufficiently advanced to allow for recovery of today’s patients (the default assigned autopsy risk is 5%, which is also quite low). Given such a high probability of failure solely from lack of institutional continuity, it should be clear why so many people, especially those who are knowledgeable and world-wise, fail to find cryonics sufficiently attractive to commit to it personally.

Money

One conclusion which may be drawn from the above is that cryonics organizations must have “Übercredibility” in every area of their operations where it is possible for them to do so. Certainly Cryonics hasn’t been a commercial success as a “fee for services” operation. There is no large queue of clients or customers waiting at the door, cash in hand, asking to be cryopreserved. The market is and has been microscopic relative to the ~57 million people who die each year on this planet. A simple summing up of the number of cryonics organization and the yearly “service fees” of various kinds they collect from their members yields a dismal number. That dollar amount for the Alcor Life Extension Foundation for the fiscal years 1990 to 2007 would come to only ~ $2,790,997.00. Over 17 years that works out to a paltry $164,176 per year. Whilst that would provide a handsome salary for the two employees at the Cryonics Institute (CI) (and likely cover all of their ancillary operating expenses not paid by patients), it would hardly suffice to pay for the number of employees Alcor has had since at least 1990, when there were 4 full-time employees being paid from the General Operating Fund (there are currently 9 full-time employees and Alcor is advertising for a tenth)..

Fundamental Financial Accountability

Repeated requests by a number of individuals have failed to elicit annual (or any other) comprehensive financial reports for the fiscal years 2006 and 2008-2010. Additionally, the 2005 Financial Statement is available only as a draft, not as the completed, certified document.  Figure 8: Failure to maintain financial accountability and to file the required government paperwork to preserve the corporate shield and to maintain tax exempt status is an indication that an organization may have become terminally dysfunctional.

Figure 8: Failure to maintain financial accountability and to file the required government paperwork to preserve the corporate shield and to maintain tax exempt status is an indication that an organization may have become terminally dysfunctional.

When corporations, large or small, cease to maintain proper financial accounting, as well as transparency and accountability to their shareholders or their members, they are signaling to the world that they are about to become, or have become terminally mismanaged. The failure to maintain and produce federally and state required financial records speaks not just to the dysfunction of the chief financial officer (CFO) and chief executive officer (CEO), but to the board of directors and the entire management team. If such lack of accountability is allowed to persist over a period of years, it may fairly be said that the members or stakeholders are also remiss by failing to demand not only financial accountability from management, but for jeopardizing the tax exempt status and the corporate shield of the organization as well.

————————————————————————————-

NOTE: In the comments section follwing this article, Alcor President and CEO Max More states that,” the (Alcor) 2008 and 2009 financial statements are complete and should be issued by the accounting firm ready to put on Alcor’s website around the end of July.” Max More, Steve Bridge and others also pointed out errors and oversights on my part relating to Alcor’s 990 Report status with the IRS. I have endeavored to correct these problems by editing this article and apologizing for any inconvenience.

————————————————————————————–

Graphic History of the Alcor Life Extension Foundation’s Financial and Membership Growth from 1984-2007

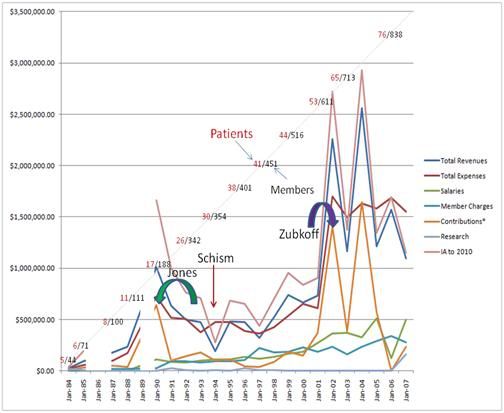

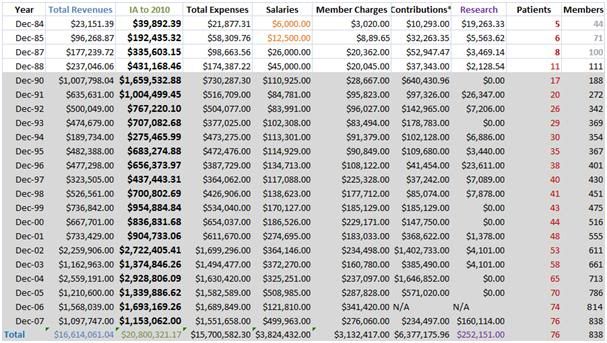

Figure 9: A graphic (incomplete) financial history of the Alcor Life Extension Foundation. Reasonably complete and consecutive data are available for the years 1987 to 2007. The two largest (known) bequests by cryopreservation patients are indicated by the large green and purple colored arrows. Money from the Jones estate began to flow into Alcor in 1988 (green arrow) and from the Zubkoff estate in 2001(purple arrow). Periods for which no data are available (1985-1987 and 1988-1990) appear as blank spaces on the graph. Because Alcor has used a variety of methods of charging members for services, ranging from Cryonics magazine to cryopreservation itself, all charges for member services such as dues and emergency responsibility fees have been consolidated into a single category, “Member Charges.” Similarly, all member Contributions, including those from bequests and directed donations have been combined under the heading of contributions. “Total Revenues” have been shown as inflation adjusted (year by year) under the heading of ÏA.”Inflation Adjustments” (IA) were carried out using “The Inflation Calculator: http://www.westegg.com/inflation/,which employs the Statistical Abstracts of the United States as its source for inflation adjustment data. Research expenditures are essentially invisible in this graph because, after 1989, Alcor spent very little on research with the exception of fiscal year2007. Tabular data for the graph above are present in Table 2.The number of Alcor Members (black print) and patients (red print) are shown at ~ 2 year intervals from 1984 to 2007 as indicated by the blue arrows. The sharp dip in revenues, expenses and contributions which takes place between ~1993 and 1994 represents the period during which Alcor underwent schism (red arrow).

When Alcor was a tiny organization with total annual revenues of less than $30,000, financial reports were prepared monthly and annual financial reports we completed and mailed to members and to all subscribers of Cryonics magazine, typically no later than the February or March following the end of the calendar year (which was also the fiscal year) ending on 31December. This level of accountability was achieved even though Alcor had no money to pay bookkeepers or accountants. Alcor’s last Form 990, which was for the fiscal year of 2009 and which was filed on 14 June, 2011 indicates that Alcor’s total assets were $9,362,293.00 (as of the end of that fiscal year).Prior to the filing of the 2009 Form 990, Alcor made a public announcement that it had received a bequest of ~ $7 million from a member who was recently cryopreserved, which is to be divided equally between the Patient Care Trust and an Endowment Fund, the latter of which is to have a maximum legally allowed annual distribution of 2% per year ($70 K/yr).[12] Thus on no account can financial hardship be an element in this failure to account. Additionally, Alcor has 9 paid full time staff members, including a full time finance director (Bonnie Magee) as well one full time volunteer.[13] As of 2009, its CEO was paid $88,819.00; a respectable sum for an organization with only 913 members and 87 patients in storage.

Table 2: Some of Alcor’s Financial parameters from 1984-2007

The data contained in the area shaded in gray are those that were obtained from formal, year-end comprehensive reports. Other data were obtained from year-end accounting summaries given to Alcor Directors at monthly meetings. Data for 1984 and 1987 are approximate (taken from a graph). “Contributions” for the purpose of this table consists of all funds given by living members as well as those given by bequest, including directed donations that supported Alcor’s non-patient care operations. Monies for long term care of patients and directed donations to the Patient Care Fund (now the Patient Care Trust) are excluded from consideration here. The source for yearly membership and patient numbers was the Alcor website.

The data contained in the area shaded in gray are those that were obtained from formal, year-end comprehensive reports. Other data were obtained from year-end accounting summaries given to Alcor Directors at monthly meetings. Data for 1984 and 1987 are approximate (taken from a graph). “Contributions” for the purpose of this table consists of all funds given by living members as well as those given by bequest, including directed donations that supported Alcor’s non-patient care operations. Monies for long term care of patients and directed donations to the Patient Care Fund (now the Patient Care Trust) are excluded from consideration here. The source for yearly membership and patient numbers was the Alcor website.

Alcor did not get its first employee until July of 1984 and the salary for this employee was paid directly to the employee by the donor until payroll capability was put in place in 1986.

A cursory examination of Alcor’s finances over the past 17 years, from 1990-2007 (data past 2007 are not available from Alcor) reveals some remarkable things. Adjusted for inflation (to 2010 dollars) Alcor has averaged an income of ~ $1,224,000.00 per year, or ~ $20,800,321 over those 17 years. Again, crudely adjusted for inflation Alcor spent ~ $289,973.00 of that ~$21 million in income on research, of which $160,114 (of the total expended on research) was disbursed in a single year (2007); in other words, 1.39%. In 4 of those 17 years the annual expenditure for research was zero.[1] However, it should noted that in both 1989 and 1990 virtually all of Alcor’s resources above those required for basic operations were necessarily committed to fight the numerous legal battles that resulted from an attempt by the state of California to outlaw the practice of cryonics.[14] Table 2 shows selected financial parameters from Alcor’s annual financial reports/statements for the years 1984- 1985 and 1987-1988 (the financial report for fiscal year 1986 is not available) and from 1990-2007.

Where’s the Beef?

When I began this analysis I had no Alcor financial data prior to 1990. After acquiring the data prior to that time in a piecemeal fashion from several resources, I added it to the spreadsheet (Table 2) but decided not to include it in the analysis of the data from 1990-2007 for several reasons; principally because 1990 is the year that the large influx of money from the Jones estate bequest had begun to dramatically transform Alcor, and it is also the year that Alcor’s new management philosophy became manifest.[15-17][i]

During this period Alcor grew from 188 members and 17 patients in cryopreservation to 838 members and 76 patients in cryopreservation. Employee compensation started to rise precipitously beginning ~ 2000, and by ~2007 it totaled ~ $500,000/yr (not adjusted for inflation). For the last year for which there are data available (2007) Alcor had year-end net assets of $103,317 and $339,052 of cash, or cash equivalents on hand. This practice of spending almost all of Alcor’s yearly revenues was not unusual. Despite a highly variable, but overall increasing revenue stream, Alcor consistently spent almost all available income, and in 2005, exceeded it. In examining the financial reports of Alcor there is no evidence of sinking funds, or other mechanisms of cash cushions to deal with the inherently erratic nature of NPO contributed income, or for major unexpected expenses such as litigation, equipment failure, publicity which adversely impacts income, or other kinds of man-made or natural calamities.

Financial records for the decade of 1972 to 1982 are apparently no longer available and may no longer exist. I was unable to locate complete financial reports for the years 1983 and 1989, although I have a number of monthly financial reports from these two years. In October of 1981 Alcor and the Institute for Advanced Biological Studies, Inc., (IABS) merged.[18] From the interval of ~ 1979 to September of 1981 Alcor was almost completely inactive; its sole patient and its member services, including patient storage, were contracted out to Trans Time, Inc., (cryopreservation services) and IABS (monthly magazine). The merger effectively transferred the human, financial and administrative resources of IABS to Alcor and marked the beginning of a fundamentally new and different organization from either IABS, or the pre-merger Alcor. Alcor did not get its first employee until July of 1984.[19] It would thus be of great interest to evaluate the financial history if Alcor from the period of 10/1981 through the end of fiscal year 1989.

As of this writing, the closest it is possible for me to come in determining the financial status of Alcor from the period of 10/82 through the end of fiscal year 1989 is to refer to a graph of Alcor yearly revenues that was prepared for in-house use sometime in 1990. Based on that graph, a rough estimate of Alcor revenues for 1982 was ~ $3,000, for 1983 ~ $13,500 and for ~ $1989 it was $320,000. Thus, a very rough summing up of Alcor’s total revenues for the period from 10/82 through 12/31/1989, adjusted for inflation to 2010 dollars, would be $1,167,595, or $ 194,599 per year. In other words, Alcor’s 6 year averaged yearly revenues for that period were ~5.61% of its averaged annual revenues for the period of 1990-2007.

[1] No detailed accounting is available for fiscal year 2005; the financial data for that year which was used to prepare Figure 7 and Table II were obtained from Alcor’s Form 990 filing with the IRS.

[i] While there were major changes to management structure in 1988, the Dora Kent and DHS litigation consumed almost all of Alcor’s time, attention and resources until early 1990. Once these matters were resolved the new management’s next focus was to initiate litigation against the California Attorney General seeking to allow Dr. Thomas K. Donaldson to be cryopreserved prior to medico-legal death because he was dying from an incurable malignant brain tumor that threatened to seriously (and irreversibly) damage or destroy his brain prior to medico-legal death.

References

1. Knaup A: Survival and longevity in business employment dynamics data: http://www.bls.gov/osmr/pdf/st060040.pdf. Monthly Labor Review 2005.(May):50-56.

2. Shane S: The Illusions of Entrepreneurship: The Costly Myths That Entrepreneurs, Investors, and Policy Makers Live By: Yale University Press; 2008.

3. Powell W, Steinberg, R.: The Nonprofit Sector: A Research Handbook. In., 2nd Edition edn: Yale University Press; 2006.

4. Keough D: The Ten Commandments for Business Failure. New Yoek: Penguin; 2008.

5. Muehlhausen J: The 51 Fatal Business Errors and How to Avoid Them, 3rd edition edn: Mulekick Publishing; 2008.

6. IRS: Data Source: IRS Business Master File, 2011. 2011.

7. Middleton M: Nonprofit Boards of Directors: Beyond the Governance Function. New Haven: Yale University; 1987.

8. Oster SM: Strategic Management for Nonprofit Organizations: Theory and Cases. New York: Oxford University Press; 1995.

9. Miller J: The Board as Monitor of Organizational Activity: The Applicability of Agency Theory to Nonprofit Boards,. Nonprofit Management and Leadership 2002, 12(4):429-450.

10. IRS: 501. Exemption from tax on corporations, certain trusts, etc: http://www.law.cornell.edu/uscode/26/usc_sec_26_00000501—-000-.html. 2010.

11. Brzezinski Z: Out of Control: Global Turmoil on the Eve of the Twenty-first Century. New York: Prentice Hall & IBD; 1994.

12. Alcor Gratefully Receives Large Bequest: http://www.alcor.org/blog/?p=1432

13. Alcor Staff: http://www.alcor.org/AboutAlcor/meetalcorstaff.html

14. Perry R: Alcor’s Legal Battles: http://www.alcor.org/Library/html/legalbattles.html. Cryonics 1999, 1st Quarter.

15. Mondragon C: A New Era Begins: http://www.alcor.org/cryonics/cryonics9301.pdf. Cryonics 1993, 14(1):10-15.

16. Mondragón C: A Stunning Legal Victory for Alcor. Cryonics 1990, 3(7).

17. Darwin M: Thomas Donaldson Files Lawsuit. Cryonics 1990, 11(6):2.

18. Staff: IABS and Alcor merge. Cryonics 1981, November(28):1.

19. Staff: Full time Alcor president. Cryonics 1984, August(49):8.

20. Kunen J, Moneysmith, M.: Reruns Will Keep Sitcom Writer Dick Clair on Ice-indefinitely: http://www.people.com/people/archive/article/0,,20120770,00.html. People 1989.

I’ve printed out a copy for Dave.

I’ve just made some corrections to the posted version of the article. Most are minor, but a couple materially impact the meaning of important statements. I’ve also corrected some labeling problems in the financial history graph. So, you should probably provide an updated version to anyone reviewing it. — Mike Darwin

Mike, this appears to be a deliberate attempt to annoy Alcor staff. Those financial statements and IRS submissions are publicly available on Alcor’s website here:

http://www.alcor.org/Library/html/financial.html

Also, the 2009 990 is the last one that would be expected to be seen. The 2010 990 is due in 2011 and does not have to be finally submitted until November 15 (the first due date is May 15, but like many other organizations Alcor can apply for an extension to its filing date).

My last check was done perhaps a week or two ago, as I began the final work on this article, certainly no more. In fact, I needed to re-download several documents that were accidentally deleted. The last I saw and downloaded 990 was from 2009. It is conceivable I missed the 990e from 2010 . I have removed my comment asking for people to contact Alcor, and I apologize for any inconvenience.

The fact still remains that Alcor has not produced any annual financial reports since 2007. The 2006 report posted on the web site is also a “draft,” not a proper (Directors’ vetted) report.

I will also (directly) amend the article itself to reflect these facts– Mike Darwin

* Alcor’s 990s are filed on time, or with allowed extensions, as required by law.

* Alcor’s 990s are publicly available on Alcor’s website

http://www.alcor.org/Library/html/financial.html

* The filing date on the 2009 990 that Mike cited is wrong. The 2009 990 was filed on time, in November 2010, not on 6/14/11 as Mike stated. (Note that the dates listed on the bottom of the pages (6/14/11) are not the dates the returns were originally created and filed. This is the date Alcor’s Finance Director had the accounting firm create PDFs to use in place of existing poorer quality versions.)

* We filed an extension for 2010, and it was accepted by the IRS. We will ultimately have until November 15th to file the 2010 990 (there will be another extension on August 15th). This will enable us to complete the 2010 review before issuing the 990, so that the 990 will not need to be amended later.

* The 2008 and 2009 financial statements are complete and should be issued by the accounting firm ready to put on Alcor’s website around the end of July.

Mike, have you looked at this page for the 990′s?

http://www.alcor.org/Library/html/financial.html

Again, I apologize. I must have missed the 990. I also posted the article whilst away and had not looked at my email since Friday PM. As it turns out, there was a communication from Steve Bridge point out this oversight and also pointing out that the IRS had granted Alcor an extension on its latest 990. — Mike Darwin

Alcor has a rather high burn rate starting from 2002. I take it this is when they got the Zubkoff money. How many suspensions do they do per year? Has the number of suspensions increased significantly in recent years?

I can tell you from my experience that the most common cause of failure is the hiring of too many staff too soon. The second most common cause of failure I have seen is spending too much money on fancy digs (facilities, offices, etc.). A successful business has to be kept lean and tight in order to ride out the inevitable economic downturn.

I’ve reluctantly come to the conclusion that Alcor is rather like a house fire; it will consume as much fuel as you give it. If it happens to be midwinter and you are in the middle of nowhere, well, at least you get to stay warm while the house burns. If it is summer, well then, you are just plain out of luck. When IABS and Alcor merged, I pushed through something called the 10% Rule, which mandated that 10% of all income, including directed donations, go into the patient care fund (PCF). There was no PC Trust in those days. The idea was to create a systemic sinking fund to protect the patients against any unforeseen contingencies. This seemed eminently sane to me then, and it only seems more so, now. The idea comes from George Clason’s book, The Richest Man In Babylon. You save 10% of your income against both the foreseen (old age) and the unforeseen.

The 10% Rule was sacked around 1990-1. The Directors and staff were hungry for more money and convinced that productivity would skyrocket. The budget had already become bloated and Dave Pizer, to his considerable credit, was screaming at the top of his lungs that we needed to cut expenditures. In fact, I was just looking over some of his memoranda and budget projections from that time period a few days ago. There wa,s in fact, a bit of expense trimming – but it was short lived. I left in ’91 and that’s where my “insider” data stops.

The rise in salaries you observe is probably an artifact of two things. The first is that Saul Kent agreed to pay for Jerry Lemler’s salary, which I’ve been told was considerably above that of the previous CEO’s. The second reason was that Lemler promptly hired pretty much his entire immediate family to work at Alcor – in addition to the staff that was already there. That included his wife, his daughter and his son-in-law! In case you are wondering, no, they were not stellar additions to Alcor’s capabilities. James Sikes, the son-in-law, actually seemed to do useful work; the others, not so much. As to how individual compensation has changed over time, well, that’s a black box and I’m pretty sure they are not going to tell you, and I’m damn sure they aren’t going to tell me (see below).

You ask about the yearly rate of cases. Yes, it has risen. However, this number in isolation doesn’t mean much. What you need to know, at a minimum, is:

1) What kind of cases were they? At need or long time members?

2) What are the precise demographics of Alcor’s membership?

3) What are the precise demographics of new Alcor members?

4) What are the current and (realistically) projected costs per case?

5) What is current and (realistically) projected revenues per case?

6) What are the contingent funds available in case LN2 goes to $3.00/L or Alcor has to move to Moscow?

Just by looking at the character of the cases they are doing (what little I can tell from the meager data available) I believe that most of the increase in cases that has occurred is to be expected. If you want to understand why, just think about the people you and I hung with when you first got involved in cryonics. Then, go to the nearest mirror and take a look. Surprise! You (and I) are now one of them. And in another X number of years it will be our turn to go into the tank. It’s the demographics of the aging process, pure and simple. Most people who signed up in 1980 were in their 40s & 50’s. Now, they are starting to arrest. Alcor has the equivalent of a cryonics boomer generation to contend with. This may not be a serious problem if the mean age of new people coming in is below 40. But, if it isn’t, then it’s worrisome, at best.

I don’t know what the number is, but I strongly suspect there is a ratio of patients to members that is dangerous to go beyond. Ditto young to old members. So, if you’ve wondered why Bill Faloon has started shelling out money to pay young people to come a “young cryonicists’” meeting, well, now you know why. I’ve had a lot of up close experience watching what happens to organizations that shift to an older demographic, and it isn’t pretty. That is what appears to be happening in cryonics.

I say appears to be, because no one will give out any data.

You wouldn’t believe my mail. One reason people don’t post to Chronosphere is that they are afraid to. I got an anonymous letter a few weeks ago, running to several pages, which purports to describe the goings on at Alcor after the “A Visit to Alcor” piece was published. I have only recently received information that makes me believe it may be credible, so I have said nothing about it; in fact dismissed it as lunatic. If it is to be believed, Max More was apoplectic – ranting about my possibly having put the patients in danger of imminent destruction and claiming I stabbed him in the back. There was apparently a special meeting called to discuss the “crisis in patient security” and there were supposedly calls for my head on a platter.

Assuming this is true, it tells me that nothing has changed; Alcor is still a closed, fearful place that will learn only from experience. The problem with learning by experience is that it is extremely slow, incredibly costly, and there is a good chance you may miss the take-home lesson after paying the steep price for admission to the “course of instruction.” One thing is clear not only from De Geus’ work, but from that of others, as well, is that a necessary element to corporate survival is multi-loop learning and open and inquisitive corporate culture. In fact, one of the most reliable signs that a corporation is dying is when it becomes closed, insular, and fearful. While there isn’t much literature on corporate longevity, there is a lot on the criticality of corporate learning modalities. Here are a few of my favorites:

Argyris, C. (1991). “Teaching smart people how to learn.” Harvard Business Review (May-June.

Collins, J. C. and J. I. Porras (1994). Built to Last: Successful Habits of Visionary Companies. Harper.

de Geus, A. (1988). “Planning as learning.” Harvard Business Review (March-April): 70-74.

Kim, D. H. (1993). “The Link between Individual and Organizational Learning.” Sloan Management Review (Fall 1993): 37-50.

Schwartz, P. (1996). The art of the long view: Planning for the future in an uncertain world. NY, Doubleday Currency.

Vaill, P. (1996). Learning as a way of being: Strategies for survival in a world of permanent white water. San Francisco, Jossey-Bass.

Wack, P. (1985). “Scenarios: Unchartered waters ahead.” Harvard Business Review (September-October): 73-89.

Wack, P. (1985). “Scenarios: Shooting the rapids.” Harvard Business Review (November-December): 139-150.

Regarding the letter, I wonder if someone tried to troll you to see if you would publicize its allegations.

Dunno, I get some really interesting stuff. One thing, which I sent along to Eugen, was hilarious. It was a nasty jibe using a riff on the Russian Oligarch Direct TV ads. Incredibly funny! — Mike Darwin

The scrapping of the 10% rule is a major problem. Not only was this necessary to help insure integrity of the patient care fund. But it also promotes fiscal discipline for the organization itself when 10% off the top goes straight into the patient care fund, no matter what.

Lemler was CEO at the time I last visited Alcor. I met him and he seemed a decent guy. I did not know he put his family on payroll. Talk about nepotism! About this time, I was in contact with Karla Steen, who was the marketing person at Alcor at the time. She had a falling out with the rest of the staff shortly after I left the Phoenix area. Lemler left the CEO position shortly after that.

I don’t know the mean age of the cryonics membership base as I’m not involved in any of these organizations at all. I suspect its rather high. The local group in Portland had a get-together when Aubrey de Grey, Greg Faye, and Ben Best attended some kind of aging conference here and most of the people at the gathering looked rather old. Yeah, fresh blood is necessary for cryonics.

I’ve had a lot of up close experience watching what happens to organizations that shift to an older demographic, and it isn’t pretty.

You know, entire countries (Europe and East Asia, including China) is experiencing this dynamic.

Look, there’s no mystery there. Most households on the planet operate the same way; they burn as much capital as they can earn or otherwise lay their hands on. The US credit card debt is anticipated to hit $1.177 trillion by the end of this year. That’s not all short-term consumer debt, that’s just credit card debt. The thirst for ready cash has gotten so bad that we’ve returned to the days of the Pawn Brokers – except now people have their cars in chronic hawk with “title loans.” In London, I saw the return of a high tech version of something that very few people ever knew existed (unless you like to watch old British films); coin operated gas ad electric meters. If you want hot water, heat, or electricity, you have to plug a little USB like thing into a solenoid on the mains to turn them on. It is pay-as-you-go utilities. And it’s already as accepted as if it had never disappeared: “Oh, hey mate, if you want a shower you need to plug this in first.” It goes without saying that such showers are to be as quick and utilitarian as possible, because the charge for gas and water under such circumstances is outrageous. Life becomes incredibly mean and vastly more costly when you fall of the perch of spending and spending. From April, when I arrived in the UK, till June when I left (2 months) food prices rose 16%! My friends there who live at the bottom of the economic stack are really beginning to feel the pinch. Lights are out when the sun sets, which is no problem at all at that latitude in the summer (it’s easily light till 1900 or 2000). But winter isn’t going to be so easy.

This is the normal human condition. We were not evolved to pass up a juicy meal that was more than what we needed when we laid our hands on it; there were no fridges, no freezers, no granaries and no other methods of calorie storage other than the fat we carry with us under our own skins. That is a miserable, mean and terrible way to live; and it is the complete antithesis of what both civilization and cryonics depend upon to function. How ironic is it that cryonics organizations, the ULTIMATE in long term endeavors, refuse to save? — Mike Darwin

From April, when I arrived in the UK, till June when I left (2 months) food prices rose 16%!

I wasn’t aware the UK was experiencing hyperinflation. The forex markets have not shown any such thing. The Pound was trading at around $1.6 in the spring and is still doing so now.

It’s complicated. You can see the graphic data of the FAO Food Index Price here: http://www.defra.gov.uk/statistics/files/defra-stats-foodfarm-monthly-brief-1101-b.pdf . There is also a cogent explanation of what is happening. To extract:

“International grain prices have risen sharply in recent months on the back of export

restrictions in Russia and the Ukraine, coupled with lower-than-expected yields as a result of

adverse weather conditions in the United States. Furthermore, dry weather in Argentina, and

more recently, heavy rainfall and flooding across eastern Australia are driving markets further

upwards.

• International wheat prices are around 75% higher than six months ago whilst global maize

prices are around 55% higher than six months ago.

• Sugar has reached a 30 year high. Soya beans prices have increased by around 40% in the

past 6 months.

• Near term wheat futures prices are above those of the previous high in February 20081

suggesting that prices are expected to remain high. However, for November delivery, UK

Liffe futures are lower in the expectation of increased global supply.”

I was lucky in that I was staying just a short walk away from Peckham Rye Street, which is the High Street in Pekham. Peckham is a rough scrabble, very ethnic area of London, and that means that it has a good 99p shop and a large LIDL. LIDL is fantastic – it is a German supermarket that sells off brands and continental brands; often at a fraction of the price of UK food. And the stuffis really good – some of it gourmet quality. The 99p store chain has stuff you really want to buy, like cokes, tinned tuna, chocolate and hygeine supplies. The stuff is good quality and it is literally a third to a fourth the price of Boots, Sainsburys, Tesco, Asda, etc. I cannot do without Coca Cola and it is incredibly expensive in the UK – about $3.00 for a 250 mL bottle. The 99p store would get these flats of cans of cokes in every once and awhile and I be fighting tooth and nail and getting elbowed by these ample-sized black women.

The99p places with best supply andlargest selection tend to be in poor neighborhoods. It is also a lot easier to get access to the dustbbins at the various food veues, providing you have a skip key.

My flatmate insisted on eating real food – the kind you cook yourself from “staples” – and the prices for things like butter have gone through the roof. When you eat packaged crap, you are to some extent, eating food at last years’ prices. Unlike petrol, downstream processed food doesn’t seem to go up in price as quickly in response to commodities supply fluctuations. I love the UK “ready meals,” which we don’thave here in the US, and I could not afford to eat them. Take away was impossible. I confined what little dining out I did to a place called the Stockpot on Old Compton Street and on Panton Street: http://www.london-eating.co.uk/4361.htm. I mention this place by name because it is an incredible value. The food is basic fare, the sercvice is good and the cost is 5 quid for a full meal. My favorite pub on the planet is Compton’s, which is just down the street from The Stockpot. And of course, Soho is full of wicked, wicked places to squander time and enjoy life. A couple times, as the sun was rising, I’ve seen Rupert Everett looking much the worse for wear, apparently headed home after a long night out. And I feel very sure I’ve spotted Dorian Gray on more than one occassion…;-)

I really miss London! — Mike Darwin

So what about the old joke:

Heaven is where:

The police are British

The mechanics are German

The cooks are French

The lovers are Italian

The teenagers are Japanese

The movie makers are American

The musicians are Russian

The women are Swedish

And the whole thing is organized by the Swiss;

Hell is where:

The police are German

The mechanics are French

The cooks are British

The lovers are Swiss

The teenagers are American

The movie makers are Japanese

The musicians are Swedish

The women are Russian

And the whole thing is organized by the Italians…

So its part of the commodities bubble. I’ve noticed our grocery prices are somewhat higher as well (around 20% since last year). Being that it is a bubble, food prices will probably go back down. It is true that everyone except for maybe the Swiss are debasing their currencies in pursuit of Keynesian scam to promote economic growth. This would also be a factor. Also, Labor under Blair and, later, Brown, did things to the UK economy that the Tories still have yet to figure out that have screwed up the UK economy.

From what I’ve heard, Blair really did a lot of damage. What are you doing in Peckham? I heard the place is mostly Muslim and African immigrants these days and is not safe.

I guess that depends upon how you define “bubble”. Food production was not as good as expected largely due to climate related events – and yes, whatever the cause, the planet is warming, at least for now. While the Russians cut exports, they did this primarily to increase their own food reserves. Food isn’t like oil – you can’t sit on it for a years and then expect to sell it. There is also the very real problem of ENORMOUS debt and continuing ENORMOUS deficit spending. Things are getting ugly in Mexico and they are already ugly in most of the Third World because there are no jobs and food prices have shot up. When you spend 40-40% of what you earn on food, as opposed to ~9%, that is a huge issue. The world wide depression is largely responsible for the social and political shift in North Africa. When they realize that “democracy” won’t make them any wealthier and that electing your exploiters rather than inheriting them does not result in more jobs, greater freedom, or cheaper food, well then things are likely to get worse. — Mike Darwin

I’ve a question for you, Mike.

There is an element of the conservative blogosphere that is full of dire warnings about how the Muslims are about to take over Europe and that the UK, especially London, is ground zero for this. An example of this is the “Gates of Vienna” blog (http://gatesofvienna.blogspot.com). Mark Steyn’s book “America Alone” was also about this theme. Have the experiences of your recent travels to the UK generally backed this theme?

What about Russia? Everything I’ve read about Russia says that they are in a demographic “death spiral” and that outside of major cities such as Moscow and St. Petersburg, the countryside is reverting back to 18th century standards and is slowly depopulating. Have you found this to be the case?

What about the story that the majority of the recruits in the Russian military will be Muslim by 2015? Also, I’ve heard that Russia has something like 8 million Turkish guest workers (just like Germany) and that Russia’s economy would collapse without them because they no longer have enough young people of their own to do all of the work? Is there truth to any of this stuff?

Russia’s population decrease has probably stopped. Putin announced that they were 20K in the green this year, but who knows? My own impression is that the demographic of decline is over and that population will likely grow, barring any other calamities. If the Russians have 8 million Turkish workers there, then they are VERY well contained. All of the Russian speaking countries are segregated and racially homogenous; Caucasians. Yes, there are regions of other ethnicity, such as Mongol and Arab/Muslim, but these are CONTAINED. If you, were, say black, and decided to take up residence in Moscow or anywhere else, you would soon flee, or be dead. It is just that simple. If you walk the streets of any major city in any Russian speaking country there are only white people. A California tan would look very out of place. The people who scrub the floors, dig the ditches, and pick up the trash are all white. Outsiders used for agriculture or construction are not intermingled with the population – that would be lethal for them in short order. And if Russia no longer needs those workers, they will send them home. And if they can’t, well, you don’t really want to think about that. Very few people in the West understand that most of the world is, by Western standards, brutally and inflexibly racist. Japan is an incredibly racist culture as are the Koreas and virtually all of the Arab world. China is only a little more flexible. People do not understand that while they visit Japan and even work there, they cannot live there. Yes, if you are fantastically wealthy it can be arranged, but you will NEVER be treated as an equal – never be able to stay at Japanese hotels…never be considered other than gaijin – alien, not them. — Mike Darwin

People do not understand that while they visit Japan and even work there, they cannot live there. Yes, if you are fantastically wealthy it can be arranged, but you will NEVER be treated as an equal – never be able to stay at Japanese hotels…never be considered other than gaijin – alien, not them.

Generally this is true.

However, I’ve never had any problem staying at Japanese hotels, whether they be business hotels or onsen resorts. Also, the onsens (hot springs) are used to gaijin as they are more into onsens than the Japanese themselves. Once you learn and get used to the system, life in Japan is actually not that bad for gaijin such as myself.

You can live in Japan either on business or marriage residence permit (I’ve had both). But you have to register at the city office and renew the residence permit every year. Getting a business residence permit is not that difficult. You have to set up a yugen-gaisha (registered company) and fund it with at least 3 million yen (about US$40,000) in a Japanese bank account.

Yes, Korea is much worse than Japan in this respect. However, South Korea does allow guest workers (Japan does not) and something like nearly half of all the kids growing up in the rural areas are mixed race, as a result of marriage between Korean men and other Asian women (Philippines, Thai, Vietnam). This will certainly change Korean society over the next 20 years.

Korea is the one of the few countries in the world that does not allow the formation of “Chinatowns”. They have a law that no two Chinese-owned businesses can be closer than X meters to each other (I think X is like 300 meters). Even Japan has chinatowns (chukagai) in Yokohama, Kobe, and Nagasaki.

Yes, I know the rest of the world is much more racist than the U.S. Its called tribalism and its very fashionable. Racism is a part of tribalism. The rest of the world (including western Europe) is tribal with a capital “T”.

While in Japan, I got used to talking about different peoples and their characteristics in a manner that would be considered racist here in the U.S. 10th century Arab scholars are quite entertaining in their descriptions of different peoples and their characteristics.

Its just the way it is (outside the U.S.).

I’m likely to respond to your comments here with a proper post to Chronosphere. — Mike Darwin

Contained? Are you sure?

http://gatesofvienna.blogspot.com/2011/09/islamization-of-moscow.html

I wonder what distribution charities and companies follow? From http://blogs.discovermagazine.com/gnxp/2011/08/the-fall-of-empires-as-an-exponential-distribution/#, describing http://arbesman.net/blog/2011/08/02/the-life-spans-of-empires/ :

> Quantitative information is often an excellent way to generate “free information” from theoretical models. The figure above is the primary result of the paper. Basically Arbesman took a data set which was laying around which measured the lengths of various empires (N = 41), and showed that the rise and fall of these political entities tends to follow an exponential distribution: e^−λt . This is an incredibly elegant summation of what we know qualitatively: some empires last a long time, but most do not.

>

> Interestingly the mean length of an empire is 220 years.

> One of the interesting points about the exponential distribution is that it implies that the the duration of an empire at any given moment can’t tell you the probability that it’s going to collapse in the near future. The distribution is “memoryless.” In other words, the likelihood of doom striking isn’t greater as time passes. This seems somewhat counterintuitive. After all doesn’t the cohesion and elan of the a ruling caste of a given empire wane as the society slowly lose its vital force? Hasn’t the author read Spengler! Arbesman admits that there are more complex equations which can describe the distribution more precisely, but the exponential formula has only one parameter, so it’s quite parsimonious. But even if we have a first approximation we don’t have a total description.