Figure 1: Fred and Linda Chamberlain with an early prototype perfusion machine.

Figure 1: Fred and Linda Chamberlain with an early prototype perfusion machine.

By Mike Darwin

Lessons from the Alcor Experience?

The Alcor Life Extension Foundation, Inc. (Alcor) and its brother for-profit organization, Manrise Corporation (Manrise), were founded in 1972 by Fred and Linda Chamberlain (Figure 1). The Chamberlains had previously been members of the Cryonics Society of California (CSC) and both had served as officers of CSC. When they became suspicious about the integrity of CSC’s financial and cryogenic patient care operations and were unable to obtain answers to their questions, they left CSC and founded Alcor/Manrise.

As was the model at the time, Alcor was the 501c3 non-profit organization tasked with accepting cryonics patients under the Uniform Anatomical Gift Act (UAGA) and acting as their custodian and advocate until such time as reanimation might become possible.

The function of Manrise was to provide the biomedical services required to cryopreserve patients and possibly to provide long term cryogenic storage, as well.[1] There were at least seven reasons at that time for dividing organizational responsibility in this way. The first was that the UAGA expressly forbade the acceptance of anatomical gift by for-profit entities; the second was that the IRS does not permit 501c3 organizations to engage in “fee for service” activities, and the third reason was the tax advantage conferred by 501c3 status. This allowed all contributed and invested income of the 501c3 organization to be exempt from taxation – including taxation by the state of California. The fourth reason was that Manrise Corporation could theoretically make a profit, but far more importantly, because it was a privately held corporation, it could shield the costly physical assets required for cryopreservation from takeover or seizure by an influx of new members into the non-profit Alcor. An associated benefit was that individuals wanting who were unwilling to contribute money to further cryonics might well be willing to invest it with the added incentives of both a financial and proprietary gain. The seventh and final reason was that it was perceived that there would be a substantial public relations advantage to having the cryonics organization responsible for the indefinite care of the patients to be a non-profit corporation.

Figure 2: Fred and Linda Chamberlain with Fred’s father, Frederick Rockwell Chamberlain, Jr., in December of 1974.

Figure 2: Fred and Linda Chamberlain with Fred’s father, Frederick Rockwell Chamberlain, Jr., in December of 1974.

In addition to wishing to have a reliable cryonics capability for themselves, the Chamberlains were under considerable pressure, because Fred’s father, Fred Chamberlain, Jr., was elderly, in poor health, and bed-bound following a stroke (Figure 2). It was anticipated that he would be the first Alcor patient, and in 1975 this anticipation was realized. The period from 1972 to 1976 was a highly productive period for Alcor. Solid platforms for administration, emergency stabilization, cryoprotective perfusion and cooling to -79○C were put into place.

Substantial basic and applied research was also carried out and the first procedure manual for cryopreserving humans was written and published by Alcor/Manrise. In 1977 the Chamberlain’s decided to relocate to Lake Tahoe, CA where they began a real estate and property business. Trans Time, Inc., (TT) of Emeryville, CA was contracted with to provide all of the administrative and technical aspects of cryonics, including storage, for Alcor’s members and patients. It was during this time that TT was aggressively trying to brand itself as the leading provider of cryonics services in the US – and succeeding.

Cryovita, IABS and Soma

The departure of the Chamberlains marked a period of steep decline for Alcor. Alcor became primarily an agency to collect fees to forward to TT, and most Alcor–initiated cryonics activity had ground to a halt by 1981. It was at this time that Alcor and the

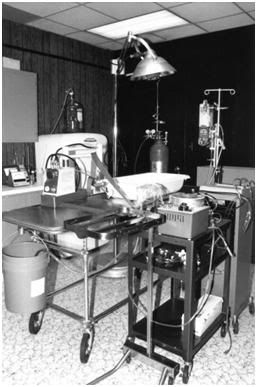

Figure 3: Operating room of Soma, Inc., and the Institute for Advanced Biological Studies (IABS) in Indianapolis, IN in 1979.

Figure 3: Operating room of Soma, Inc., and the Institute for Advanced Biological Studies (IABS) in Indianapolis, IN in 1979.

Institute for Advanced Biological Studies, another small, struggling cryonics group based in Indianapolis, IN merged. Thus began the second dynamic period in Alcor’s growth and in its generation of scientific and technical advances in cryonics. While Manrise Corporation had merged with TT, a new company and a new person had entered cryonics, Cryovita Laboratories and Jerry Leaf. It was Jerry Leaf and his lab that prompted my move to Fullerton, CA and it was Jerry’s technical expertise and immense personal authority that were critical to establishing Alcor’s credibility. When Alcor and IABS merged in late 1981, Jerry was a subcontractor to TT. However, he chafed at this relationship and soon decided to focus his resources and efforts on the people he was surrounded with in Southern California – the same people who were contributing most generously of their time, money and effort to his research projects – Alcor members.

Hidden Resources

It is important to understand the relationship between Cryovita and Alcor because failure to do so will lead to a critically distorted and skewed picture of the capital and labor required to achieve what was achieved from ~1982 to 1991. This same admonition pertains to most other cryonics organizations that have existed where there was an associated for-profit entity. In the case of the Bay Area Cryonics Society (BACS) and TT, the majority of the capitalization in cash and contributed labor was to TT, not BACS.

The complete financial records of Cryovita exist from the period of 1981 to 1991 – every cancelled check and every receipt carefully catalogued by internal account. It is a large mass of data of about the volume of 3 “banker’s boxes.” Providing this data is preserved (and preferably digitally captured) it will be possible to dissect the exact contribution Cryovita made (and it is very substantial). It will also be possible to see to what extent Alcor had direct financial input into this contribution by virtue of the accounts receivable from Alcor to Cryovita. For now, all I can do is to give a seat of the pants estimate and suggest that over that ~10 year period, Cryovita added at least half again as much value to the efforts described below as did Alcor, if not more so. That would be ~ $625,000 inflation adjusted to 2010 dollars.

However, that does not take into account to the considerable time and the unique expertise and intelligence brought to bear in acquiring assets. For instance, it is likely that by 1983, Jerry Leaf and I[2] had spent perhaps $150,000 in 1982 dollars on biomedical equipment ($334,359 in 2010 dollars). Almost all of that equipment was acquired at university surplus property sales, government auctions, and from salvage medical equipment dealers for between $0.01 and $0.10 on the dollar of the new purchase price. Such equipment, if intelligently purchased, is almost always serviceable, but it requires enormous amounts of time to acquire it, it must be refurbished as needed, and it required considerably more effort then ( in the pre-Internet era) than now to acquire documentation to operate and service it. It was thus both reasonable and conservative for Jerry to estimate the current (new) replacement cost at ~ $1 million in 1982 dollars.

Figure 4: The entrance to Cryovita Laboratories located at 4030 N. Palm, Unit 304 in Fullerton, CA circa 1979.

Figure 4: The entrance to Cryovita Laboratories located at 4030 N. Palm, Unit 304 in Fullerton, CA circa 1979.

The Business Liability Insurance Crisis

An additional consideration is that early in 1985 it became impossible for Cryovita to obtain basic business liability insurance due to the liability insurance crisis of the 1980s. Since Alcor was a rent free co-tenant with Cryovita this meant that both companies faced imminent eviction, since it was (and is) a requirement of most commercial landlords that the tenants maintain a substantial sum in coverage. In the case of Cryovita and Alcor, this was $ 500,000 in 1985 dollars. The liability insurance crisis had profound implications for cryonics because it meant that Cryovita and Alcor could not simply find another landlord, or even obtain a loan to purchase a building, since any institutional loan would need to be secured against tort action with liability insurance. It was thus necessary to identify and purchase a suitable facility in cash, and as quickly as possible.

In order to purchase such a facility, a limited liability partnership called the Symbex Property Group, was created by the author in 1985 and $193,000 in capital was raised over a~ 3 year period: $158,000 was raised by closing time on the building, which took place on 24 December, 1986 ($365, 445 in 2010 dollars). Alcor directly owned $31,267 in Symbex shares. When the building sold on 24 May, 1995 during a major depression in Southern California commercial real estate prices it sold for $127,000. It thus seems reasonable to credit to Alcor half the inflation adjusted purchase price ($187,722).[3] If the capital contribution from Cryovita is added to the estimated capital contribution from Symbex, that works out to an additional $522,081 inflation-adjusted (2010) dollars that might reasonably be added to the $1.25 million in direct expenditures by Alcor between 1983 and 1989, for a very roughly estimated total of $1,772,081.[4]

In hindsight, that seems an impossibly small number given what was accomplished. In 1981-2 we had virtually no money beyond covering the lease and the utilities. Buying a can of spray paint to spruce up the battered appearance of otherwise serviceable equipment was a luxury, and a painful one, at that. Virtually all of my surplus income was going into the two operations, as was Jerry Leaf’s. In fact, in Jerry’s case, the bulk of the salary he earned as a researcher in the Department of Thoracic Surgery at UCLA was going to support Cryovita, while his wife and two children were largely being supported by his wife’s income as a Registered Nurse in a supervisory position at a community hospital.

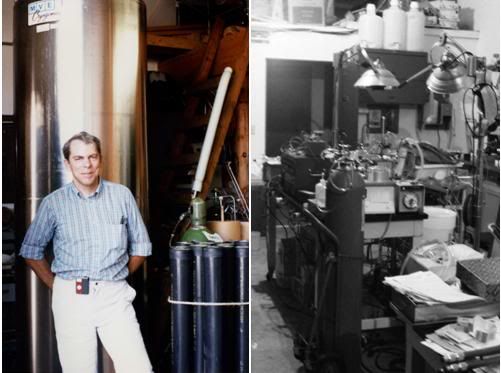

Figure 5: Cryovita occupied a small, impossibly cramped industrial bay in Fullerton, California. Animal research and human cryonics cases were carried out using the same facilities. At left, above, Jerry Leaf stands next to Alcor’s first dual patient cryogenic dewar, proudly sporting the MVE logo.

Figure 5: Cryovita occupied a small, impossibly cramped industrial bay in Fullerton, California. Animal research and human cryonics cases were carried out using the same facilities. At left, above, Jerry Leaf stands next to Alcor’s first dual patient cryogenic dewar, proudly sporting the MVE logo.

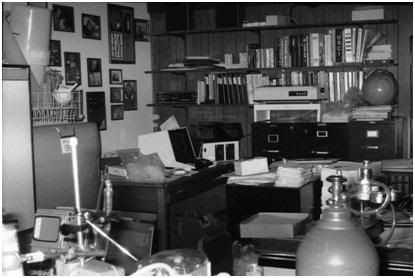

Figure 6: With the exception of the operating room and the office/reception area, the bay was neither subdivided not heated or cooled. It was often miserably cold in the winter (~ 15○C) and brutally hot in the summer. Dust, which poured in from over and around the roll-up door at the back of the bay and through the skylight, was a constant problem.Above is the Alcor office at appeared in 1983.

Figure 6: With the exception of the operating room and the office/reception area, the bay was neither subdivided not heated or cooled. It was often miserably cold in the winter (~ 15○C) and brutally hot in the summer. Dust, which poured in from over and around the roll-up door at the back of the bay and through the skylight, was a constant problem.Above is the Alcor office at appeared in 1983.

Figure 7: Before the operating room was constructed, patient cryopreservations and research work were conducted in the undivided industrial bay. Wiring was makeshift, comfort was non-existent, and the whole operation functioned on a shoestring. Above, a canine total body washout conducted at Cryovita in 1978 or 1979.

Figure 7: Before the operating room was constructed, patient cryopreservations and research work were conducted in the undivided industrial bay. Wiring was makeshift, comfort was non-existent, and the whole operation functioned on a shoestring. Above, a canine total body washout conducted at Cryovita in 1978 or 1979.

Figure 8: The all-volunteer research staff at Cryovita during a canine TBW after the (unsuccessful) experiment circa 1978-79. Left to right: Jerry Leaf (hands), Betty Leaf, Reg Thatcher, Greg Fahy, Tom the Perfusionist, Cath Woof and (barely in frame) Thomas Donaldson.

Figure 8: The all-volunteer research staff at Cryovita during a canine TBW after the (unsuccessful) experiment circa 1978-79. Left to right: Jerry Leaf (hands), Betty Leaf, Reg Thatcher, Greg Fahy, Tom the Perfusionist, Cath Woof and (barely in frame) Thomas Donaldson.

Waste Recovery

Two other sources of revenue thus should be mentioned. The first is the enormous wealth and the enormous waste of the US at that time (and to a lesser extent, now) both in general, and in the healthcare sector, in particular. It is currently estimated by the Government Accounting Agency (GAO) that there is $60 to $90 billion a year in Medicare fraud. This represents deliberate, overt fraud – not waste in the system, or what I would call “soft” fraud, where perfectly serviceable equipment is replaced with the latest model, acceptable consumables are replaced with a different brand because of physician/administrator preference, or more rarely, because of kickbacks from suppliers.

A commonplace example was that of a cardiac surgeon wishing to switch the brand of oxygenator, tubing packs or other consumable supplies used in the operating room. Such a change in vendors may reflect a real medical advantage, or may even be worthwhile because it increases the safety and efficiency of the surgeon, or his supporting staff. Often, however, any perceived technical advantages are illusory. The primary reason for switch-overs is economic: the hospital corporation has negotiated a better deal with a different supplier. Where complex devices are involved, such as blood oxygenators, there needs to be in-house training (in-services) for the new device, and switchover needs to be abrupt and complete, to avoid possible confusion.

A result of this is that whatever remains of the existing stock of devices is discarded. Often the new vendor takes custody of these devices and destroys them to prevent any possible price depression resulting from a bolus of “free” oxygenators entering the marketplace (the same procedure is also often used with hardware, such as dialysis machines and IV pumps). Of course, sales people are by nature entrepreneurial and if they can find a market outside of the clinic where they are sure the product they were supposed to have destroyed will not harm their market, they are not adverse to selling it for whatever that market will bear; typically 25% to 30% of the wholesale price. These kinds of vendor-change generated surpluses were a major source of consumables for us during those years.

Figure 9: A Clay Adams Becton-Dickinson 0151 Analytical Centrifuge of the kind commonly discarded after home-dialysis patients died or returned to –in-center hemodialysis. These units retailed for ~$500 in 1982.

Figure 9: A Clay Adams Becton-Dickinson 0151 Analytical Centrifuge of the kind commonly discarded after home-dialysis patients died or returned to –in-center hemodialysis. These units retailed for ~$500 in 1982.

A similar bonanza was to be had, in this case free for the taking, with respect to hemodialysis (artificial kidney) supplies. A small fraction of patients receiving hemodialysis undergo the treatment at home where it is administered by a spouse, friend, or paid private giver. Medicare pays for the procedure and provisions the patients’ homes with both consumables and hardware. In the event the patient returns to in-center dialysis or dies, the consumable supplies cannot be returned for use by other patients because of concerns over storage conditions and the (remote) risk of infectious disease transmission. Hardware, such as centrifuges use for hematocrit determination[5] that were difficult to clean and impossible to sterilize, were also discarded.[6] Usually all it took was a phone call to the patient, or his next-of-kin, to get these supplies at no cost – in fact, most people were grateful to have the many cases of dialysate, dialyzers and many other supplies carted off from their home.

Figure 10: Cryovita was located in an industrial park a few hundred yards from a major Southern California drug wholesale warehouse. Experimental dogs were walked along the concrete wash (photo at lower right) or in the field on the other side of the wash. A red X marks the location of the PRN dumpster where we used to recover discarded medical products. The image is from Google Earth and the building which currently occupies the lot labeled “Dog Exercise Field” has been removed using Photoshop.

Figure 10: Cryovita was located in an industrial park a few hundred yards from a major Southern California drug wholesale warehouse. Experimental dogs were walked along the concrete wash (photo at lower right) or in the field on the other side of the wash. A red X marks the location of the PRN dumpster where we used to recover discarded medical products. The image is from Google Earth and the building which currently occupies the lot labeled “Dog Exercise Field” has been removed using Photoshop.

Another artifact of great wealth and careless government spending on healthcare is waste due to inefficiency. When Jerry Leaf leased the Cryovita industrial bay, he had no idea what a fortuitous choice he had made. As it turned out, a wholesale drug house was located only a few hundred yards from Cryovita. In the early 1980s, the lot adjacent to the drainage wash that lay in back of the building opposite Cryovita was not yet developed. We initially used the area along the wash to walk our research dogs. However, concerns over possible exposure to the long duration defoliant agent used on the ground along wash, led us to begin walking the animals in the empty lot on the other side of it. Being inveterate dumpster divers, Hugh Hixon and I soon discovered that the PRN Wholesale Drug warehouse discarded its expired products in a dumpster that tantalizingly abutted the vacant lot where we exercised the dogs.

Figure 11: Above left, dozens of doses of Unipen (nafcillin) parenteral antibiotic recovered from the dumpster of PRN. At right, boxes of perfusion supplies, dialyzers and ethylene oxide sterilization wrap all obtained for free, or at pennies on the dollar. Photo 28 May, 1995.

Figure 11: Above left, dozens of doses of Unipen (nafcillin) parenteral antibiotic recovered from the dumpster of PRN. At right, boxes of perfusion supplies, dialyzers and ethylene oxide sterilization wrap all obtained for free, or at pennies on the dollar. Photo 28 May, 1995.

Typically, several times a week varying quantities of expired medications and IV fluids would be deposited in the dumpster stilli9n its original shipping packaging. The sheer variety and volume of parenteral products that were discarded still boggles my mind these many years later. Often, product was discarded months before its expiry, because customers will often refuse to accept medications that might expire before they can use them. Expiration dates on most drug products are set very conservatively, and in any event, preparations that consist only of simple molecules, or otherwise stable molecules, may be safely used for years beyond their expiry,[7] depending upon how they are packaged and how they are stored.

Lyophilized, stable molecules stored in glass under a vacuum have an indefinite shell life, as do IV fluids (in glass) such as saline, Ringer’s solution and other solutions containing only simple ions.[8] Thus, if the solution is clear, free of particulates and still under vacuum it may be safely used. Most antibiotics cannot be used safely much beyond their specified expiry, but this time may be greatly extended by simple refrigeration of the vacuum packed powder.

PRN also sold a wide range of the most commonly used medical disposables, such as syringes, needles, catheter over needle IV access devices, gauze, dressings and topical products. As a consequence of this essentially free largesse, Cryovita/Alcor was supplied with most of the “routine” parenteral products needed for research, as well syringes, needles, dressings, and so on. Figure 11, above, is a photograph of a large lot of Wyeth Unipen (nafcillin) antibiotic. At that time, most staph was still not resistant to nafcillin and this bonanza of free antibiotic carried us through ~5 years of animal experiments (it was stored at -20○C in a non-frost free household freezer).

Without a very careful analysis of the research done during this period, it would be impossible for me to gauge the contribution that this kind “underground” materiel represented in terms of dollars and cents. Certainly it amounted to many thousands of dollars and perhaps tens of thousands until ~1987 when the FDA mandated drug suppliers destroy expired or discarded product to prevent it from being re-utilized.

End of Part 7

Footnotes

[1] The primary focus of Manrise was on developing rescue and cryoprotective perfusion capability, since Trans Time, Inc., was already providing storage service in the Bay Area.

[2] When IABS merged with Alcor, Soma, Inc., the for profit brother organization to IABS, of which I was the principal stockholder, merged with Cryovita. This combined the capital assets of both entities.

[3] This is so because those shareholders who did not recover their investment may be reasonably considered to have subsidized Alcor’s occupancy of the building with their losses since the rent Alcor paid during its tenure in the Symbex building was well below market rate (~ $1,000/mo; the precise amount was determined on the basis of Alcor’s yearly income.)

[4] The reader should feel free to round those numbers up to $2 million or down to $1.5 million per their preference. My own guess is that the $1.5 million (inflation adjusted to 2010 dollars) figure is the more accurate.

[5] I note that one of the same model Clay Adams Becton-Dickinson 0151 Analytical Centrifuges I used to obtain from deceased home dialysis patients’ homes has a “buy it now” price on eBay of $449.99: http://cgi.ebay.com/Clay-Adams-Becton-Dickinson-0151-Analytical-Centrifuge-/230378218928.

[6] Hepatitis B (HBV) was endemic amongst dialysis patients and their caretakers due to their need for frequent blood transfusions. There was no vaccine at that time, and this blood-borne illness had considerably morbidity, and a long-term mortality rate of 3-5%. Blood handling equipment was often heavily contaminated with the virus. Since I had been infected with and recovered from HBV, this was not a concern for me and I could safely invest the time to sanitize the equipment.

[7] This used to be a major cost-saving “subsidy” for animal research. However, animal rights activists successfully lobbied the USDA to forbid the use of expired product – drugs or devices – on experimental animals.

[8] Stopper composition is also critical; with butyl rubber stoppers offering the longest post-expiry shelf life.

california in the early 80s really was a wealthy place. When I got out of the military in in CA in that time period, you could go to school on the GI bill and collect unemployment at the same time.

Those days really are long gone.